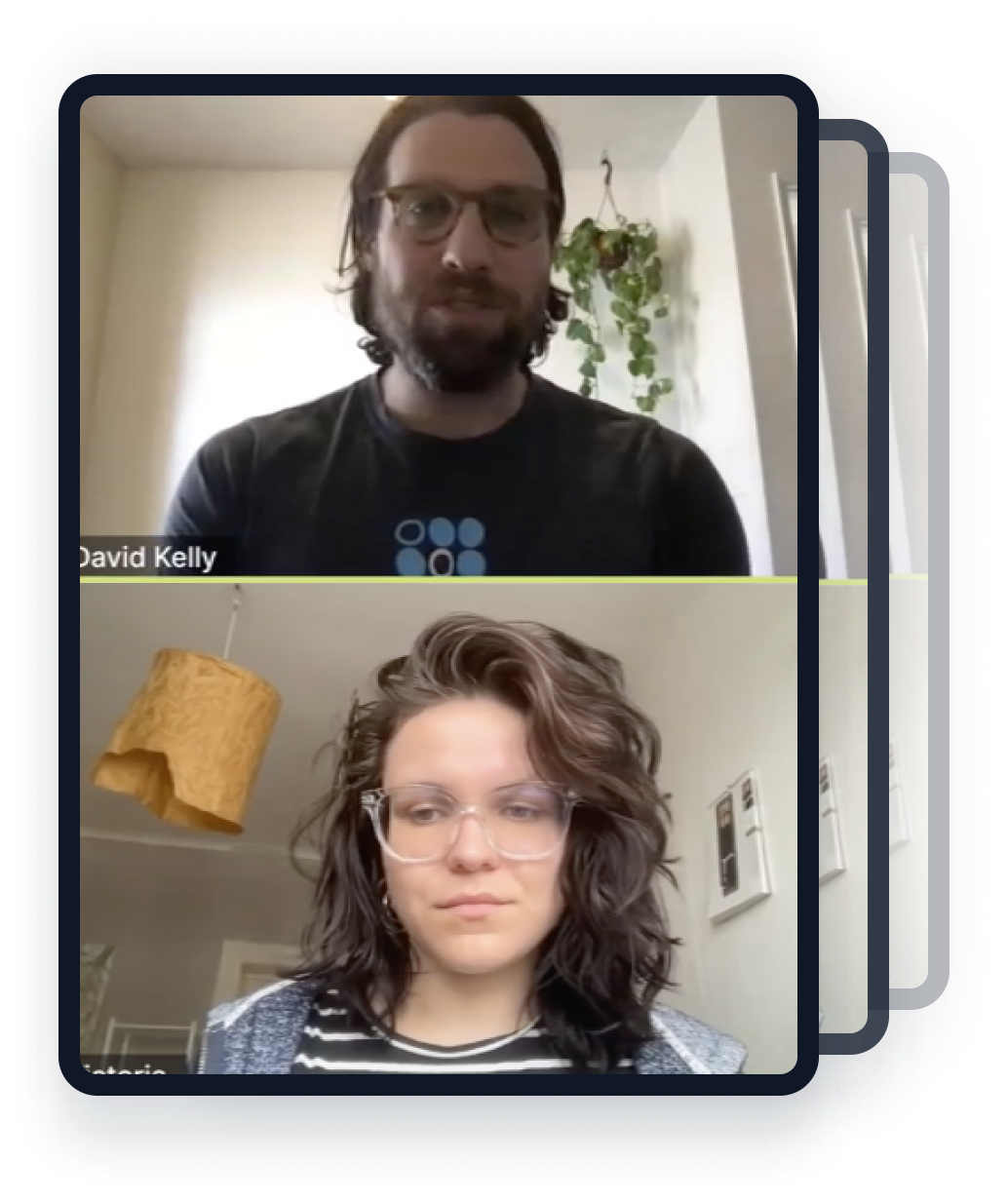

“It’s insane how I’m able to hop on Zoom calls with hundreds of experts that work at some seriously impressive companies!”

Find mentors with payments industry experience

Connect with the right people and get unstuck

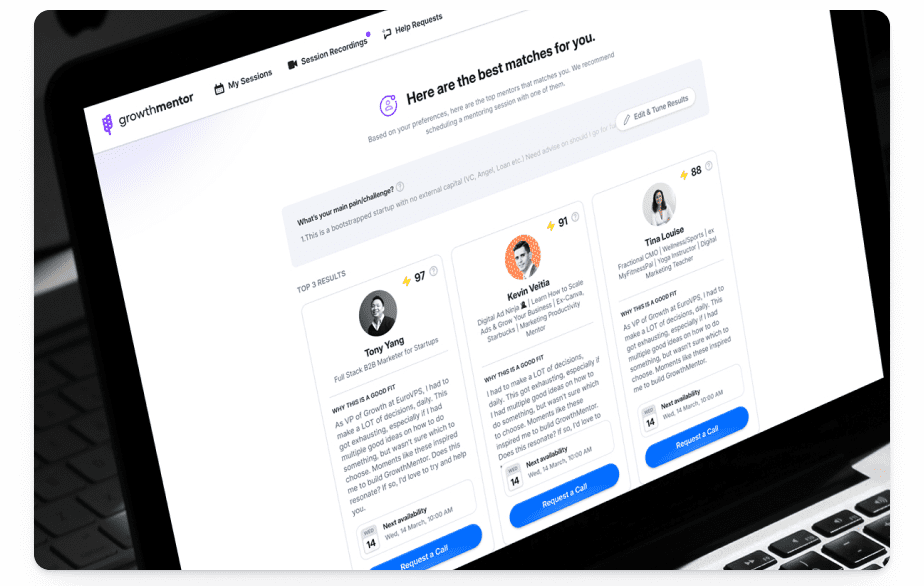

Find your mentor

Book a Call

Get unstuck

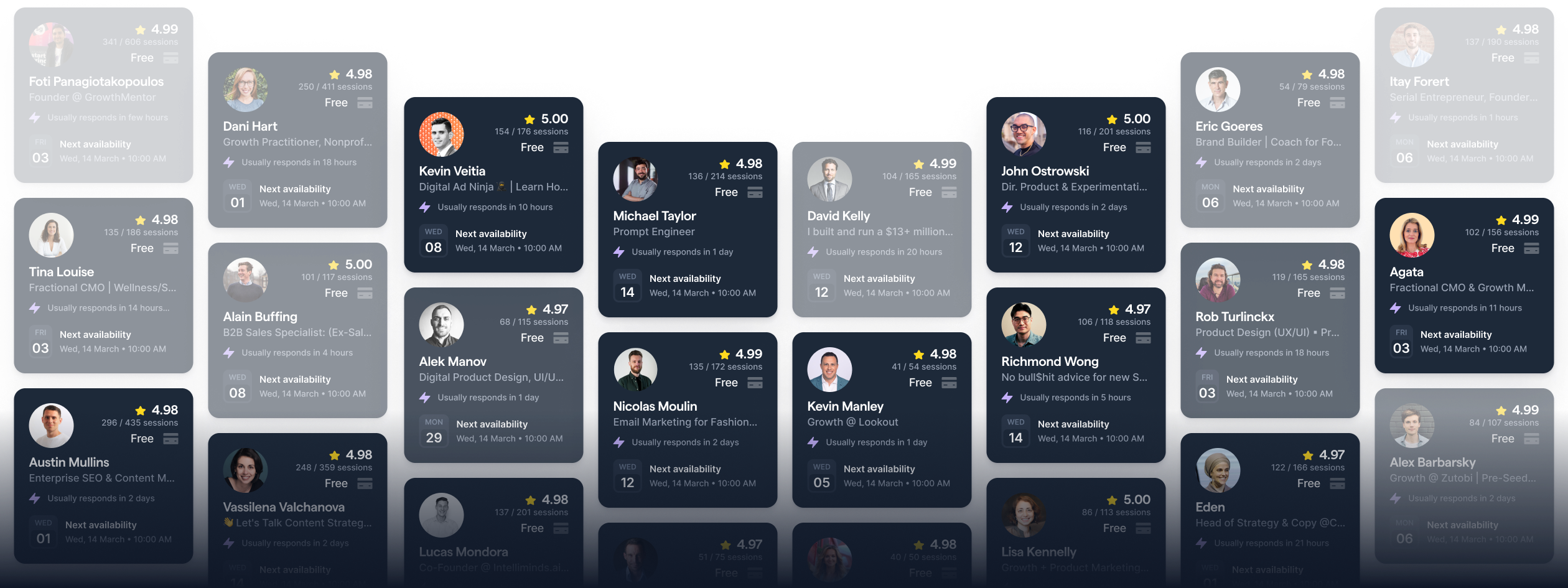

Payments industry mentors at your fingertips

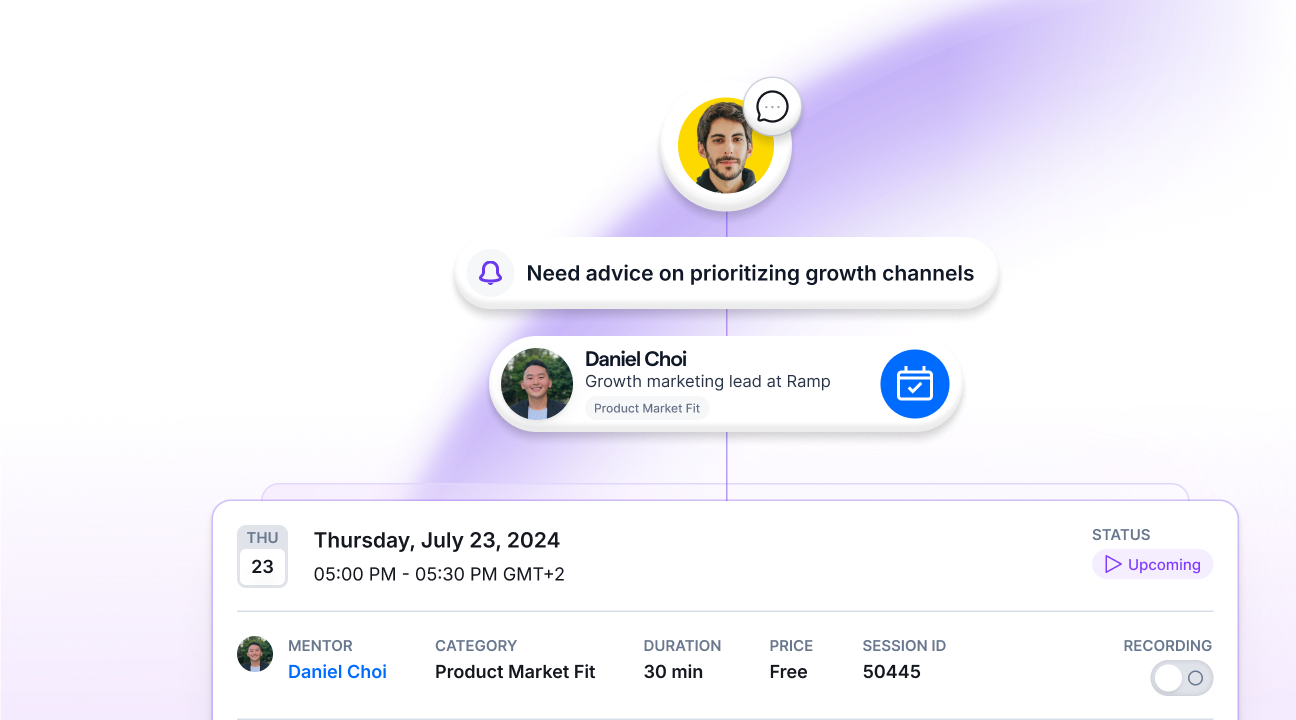

What would you like to get better at today?

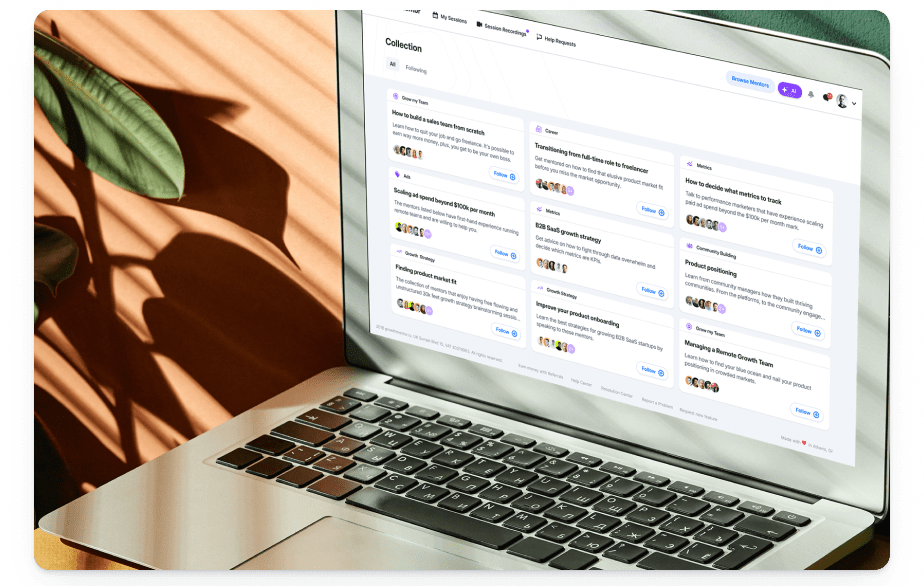

Just a few of the topics being discussed over casual conversations on GrowthMentor

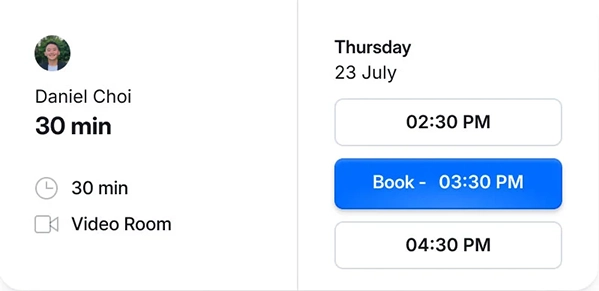

Book Zoom calls with vetted payments industry mentors and receive personalized advice that's relevant to your situation.

What should we prioritize in MVP?

How do we handle regulatory compliance?

Which payment methods should we offer?

How do we ensure payment security?

What’s the best way to prevent fraud?

How should we handle chargebacks?

What pricing model should we use?

What metrics should we track for success?

What should our user onboarding process be?

What’s our customer support strategy?

How do we ensure a seamless UX/UI?

How should we approach fundraising?

What data privacy measures should we take?

How do we stay updated with industry changes?

All your questions about mentorship, answered

Why should I talk to a payments industry mentor?

Starting a payments startup isn’t easy. It’s a field with its own set of regulations, technology needs, and market dynamics.

Navigating the payments space requires more than just a good idea. It demands a thorough understanding of payment processing, security protocols, and customer behavior.

While general advice and industry reports can be helpful, there’s no substitute for the insights of someone who has experienced the journey firsthand. The right mentor can help you avoid common pitfalls, optimize your operations, and make smarter decisions.

Wouldn’t you prefer to have a guide who’s been through it all?

You can. Just talk to a payments industry mentor.

What can a payments industry mentor do for me?

Most payments industry mentors bring extensive experience from working in or with payment systems. Some have been involved in successful payments startups or have deep knowledge of compliance and security.

These mentors offer practical advice tailored to the payments industry. They can help you understand payment processing, ensure security, and develop products that resonate with users.

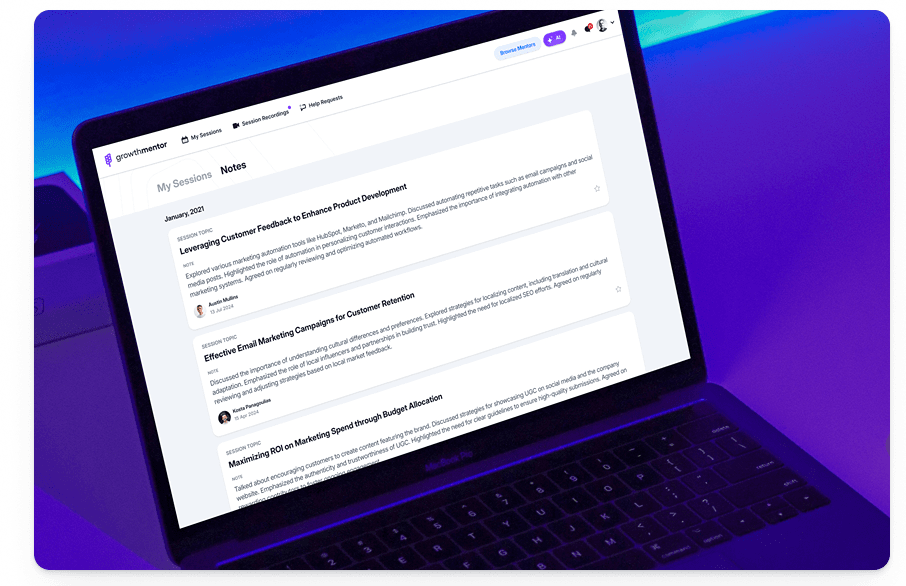

With their guidance, you’ll gain clarity on your path to success. They’ll assist with everything from creating a solid business plan to implementing technology solutions and managing risks.

For more advanced needs, a payments mentor can provide expertise on scaling operations, refining customer acquisition strategies, and navigating complex regulatory issues. They might even share real-world examples from their own ventures to help you learn directly from their experiences.

This way, you can make informed decisions, avoid common mistakes, and accelerate your startup’s growth.

Should I talk to a payments industry mentor now?

Whether you’re just starting your payments startup or have already made progress, talking to a payments industry mentor can be incredibly valuable.

If you’re at the beginning, a mentor can help you understand the industry landscape, develop a solid business plan, and navigate initial regulatory hurdles. They’ll offer strategies for securing investment and setting up payment systems.

If you’re further along, a mentor can assist with:

- Navigating complex payment regulations

- Securing additional funding or partnerships

- Optimizing your technology stack and operations

- Developing effective customer acquisition strategies

- Addressing challenges with scaling or market penetration

Even experienced founders can benefit from a mentor’s insights to refine their strategies and tackle new challenges.

Why should I trust GrowthMentor’s mentors?

Excellent question. After all, the “mentorship” world is full of high-priced consultants, armchair analysts who have never done the work themselves, and outright snake-oil salesmen looking to make a quick buck.

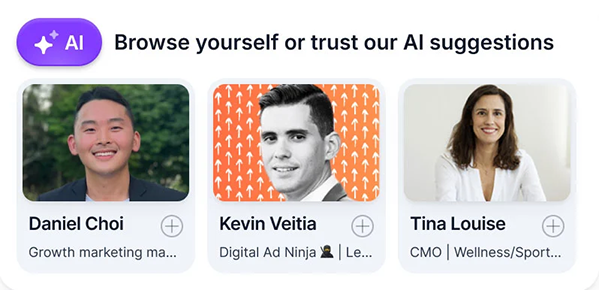

But, there are plenty of experts out there who want to share their experience and knowledge. At GrowthMentor, we’re lucky to have 700+ of those experts.

The secret comes from our vetting process. We not only double-vet all of our mentors so only the top 3% makes it through our process, we also look at their soft skills. Because no one wants a mentor who’s a snob or a jerk.

On top of it, 85% of our mentors don’t charge an extra fee. Why?

The short answer: Because they want to help people.

The long answer is because…

- They enjoy sharing their knowledge

- They learn from their mentees

- They want to be a “force for good” in the business world

- They want to pay it forward

But don’t just trust our word on it. Hear from the mentors themselves.

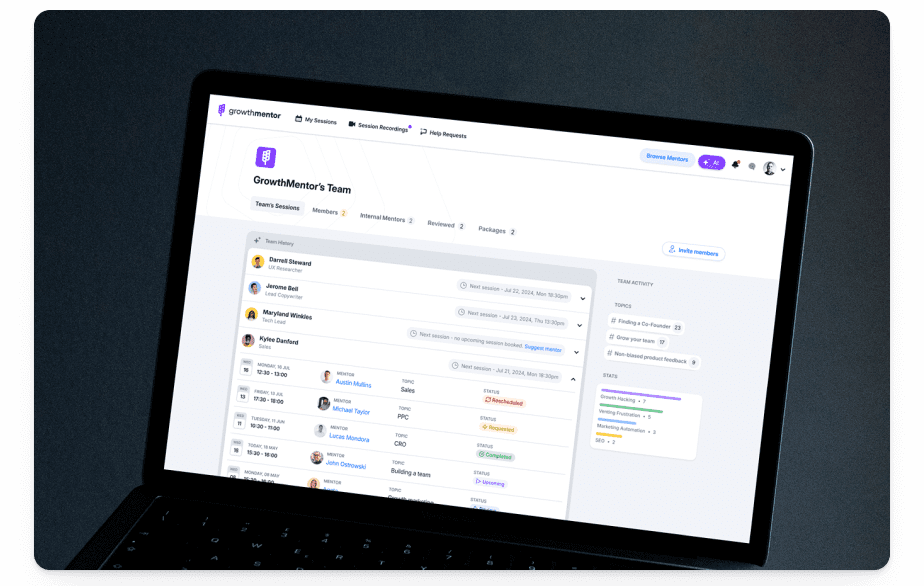

Join the most uplifting community on the internet

Frequently asked questions

Our mentors are the top 3% of their field. Every mentor goes through a strict double-vetting process to ensure they’re the best of the best.

But, when vetting, we also look at an applicant’s soft skills:

- Does this person have the patience to hop on a call with a total newbie?

- Can they hang with someone who is even more advanced than themselves in a certain area?

We’re looking for humility, kindness, and warmth.

These traits are what set Growth Mentors apart from other “gurus”.

They want to share their knowledge and help.

The short answer? Because they want to help people.

The long answer? Because…

- They enjoy sharing their knowledge

- They learn from their mentees

- They want to be a “force for good” in the business world

- They want to pay it forward

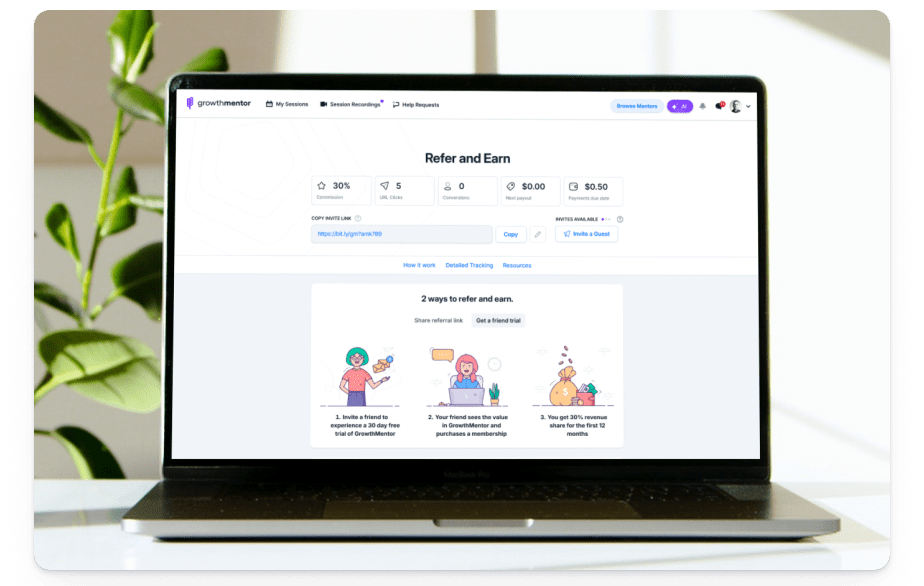

Yep. Purchase a pro plan and you get unlimited calls every month.

GrowthMentor is the only startup mentorship platform in the world where a single flat-rate subscription gets you unlimited access to hundreds of world-class mentors.

No exorbitant per-session fees, – think Netflix, but for 1:1 calls with startup mentors.

Two words: active learning. When your team goes to AI with their problems, they’re often consuming the information, but not applying it.

By talking things through with a mentor, your team members will sharpen their understanding of their challenges and find routes to put the advice into action faster than they could with an AI solution.

Yes. If it’s not for you, simply cancel your membership within 14 days and contact support for a full refund.

Note that refunds are not possible if you’ve breached our terms of service.

.jpeg)

.png)

.jpeg)