“It’s insane how I’m able to hop on Zoom calls with hundreds of experts that work at some seriously impressive companies!”

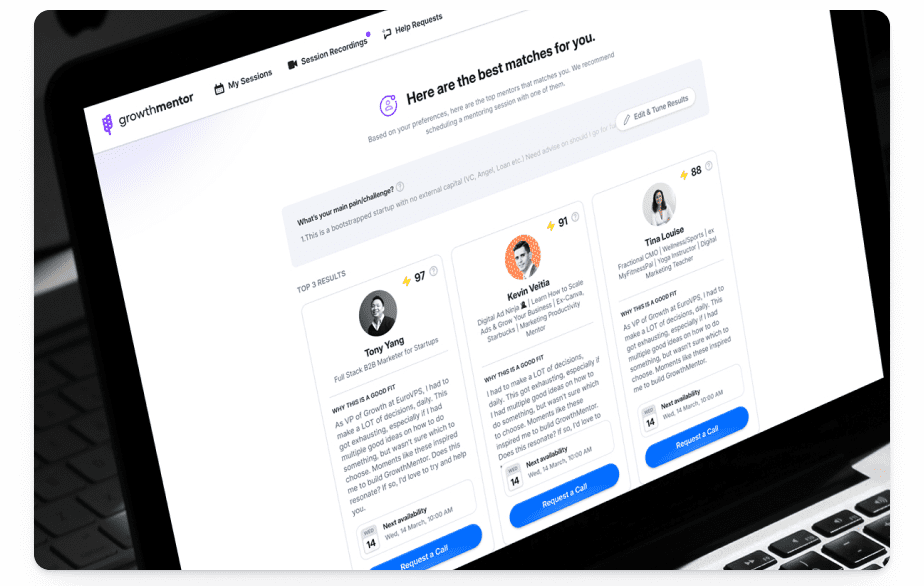

Find fintech mentors easily

Connect with the right fintech mentors and get unstuck

Find your fintech mentor

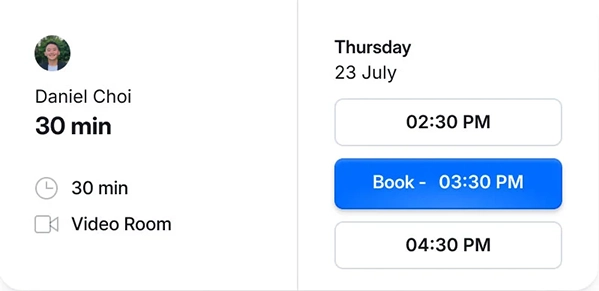

Book a Call

Get unstuck

Fintech mentors at your fingertips

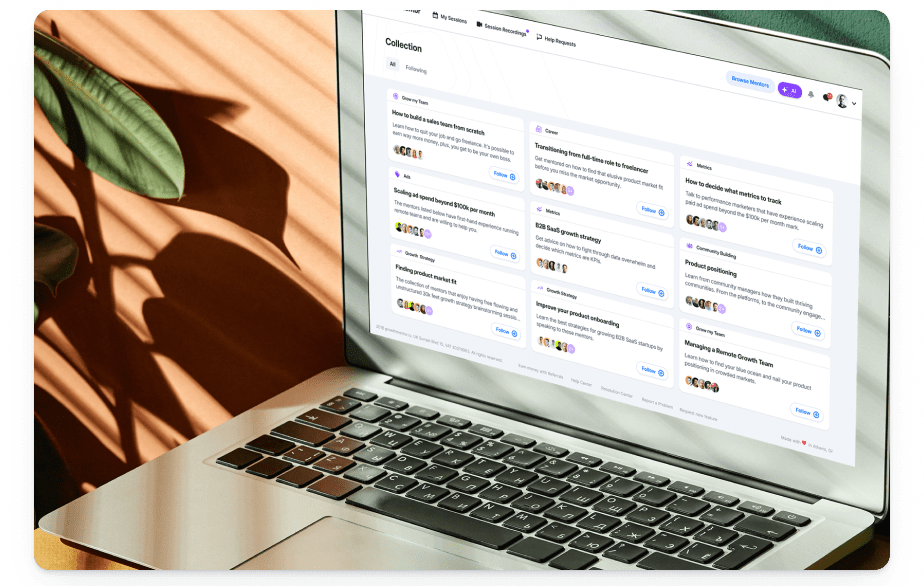

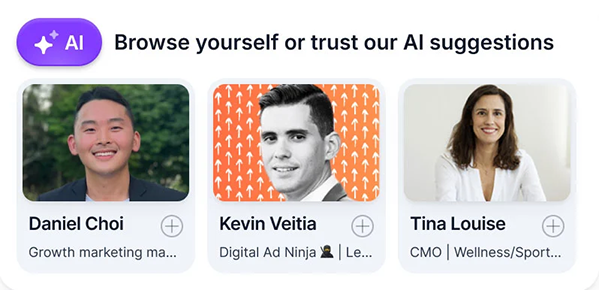

What would you like to get better at today?

Just a few of the topics being discussed over casual conversations on GrowthMentor

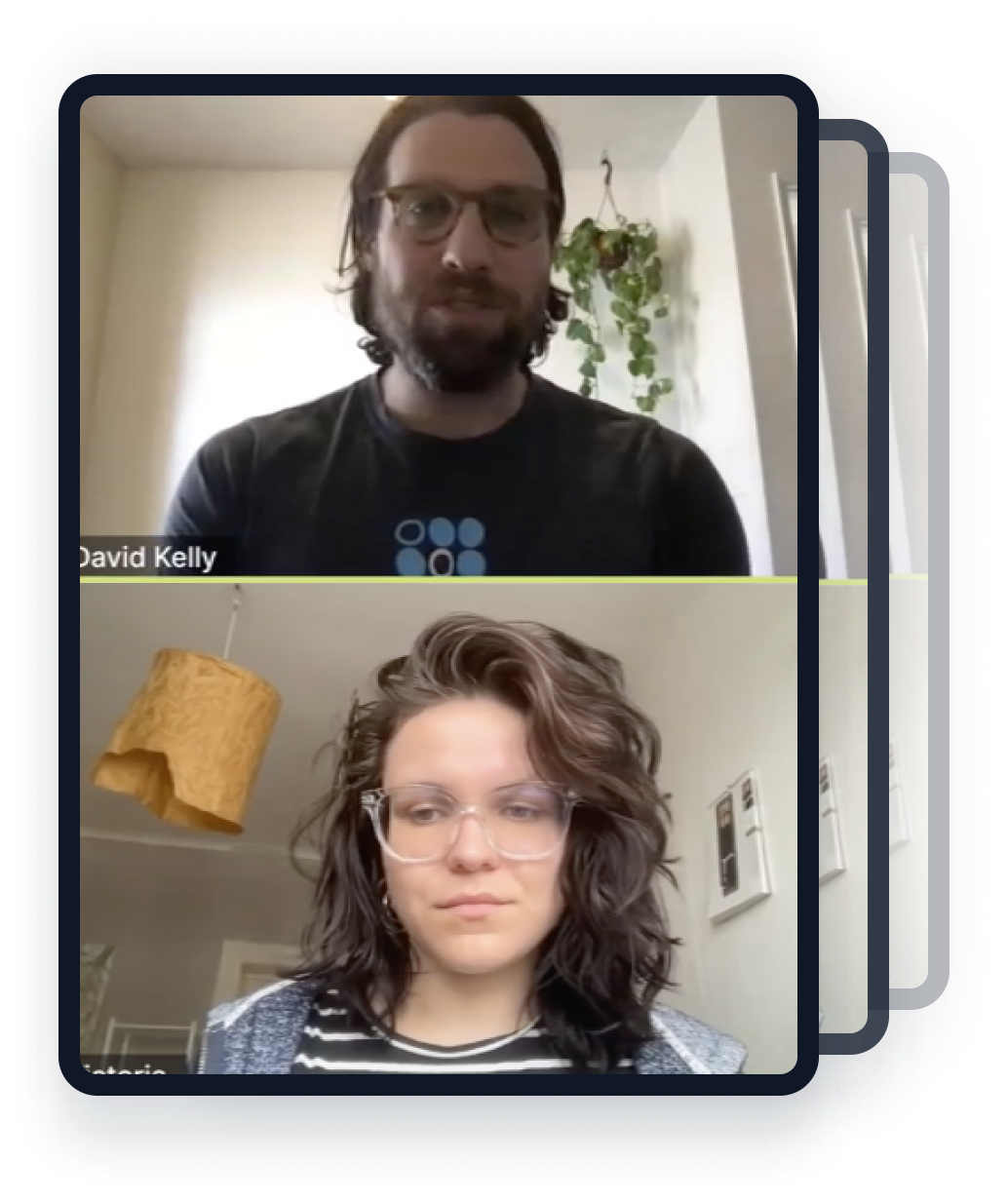

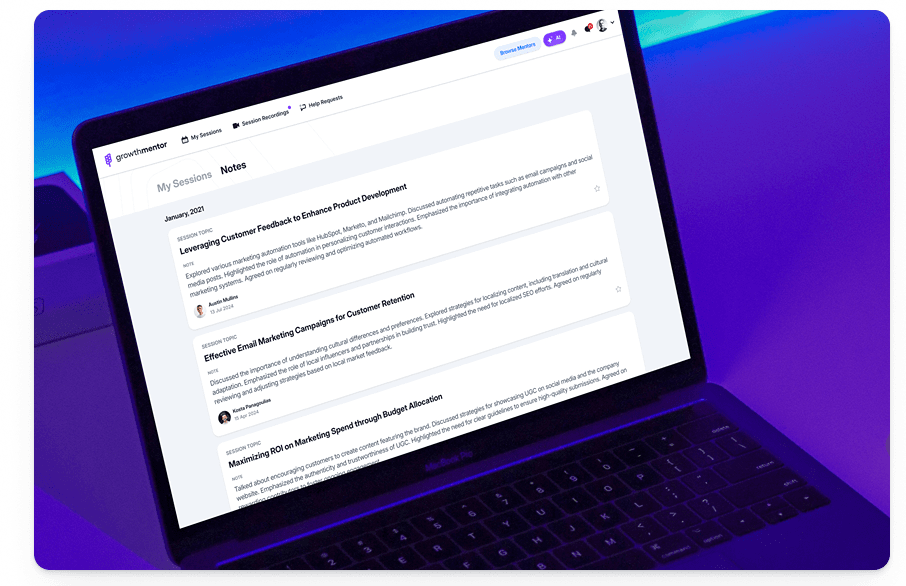

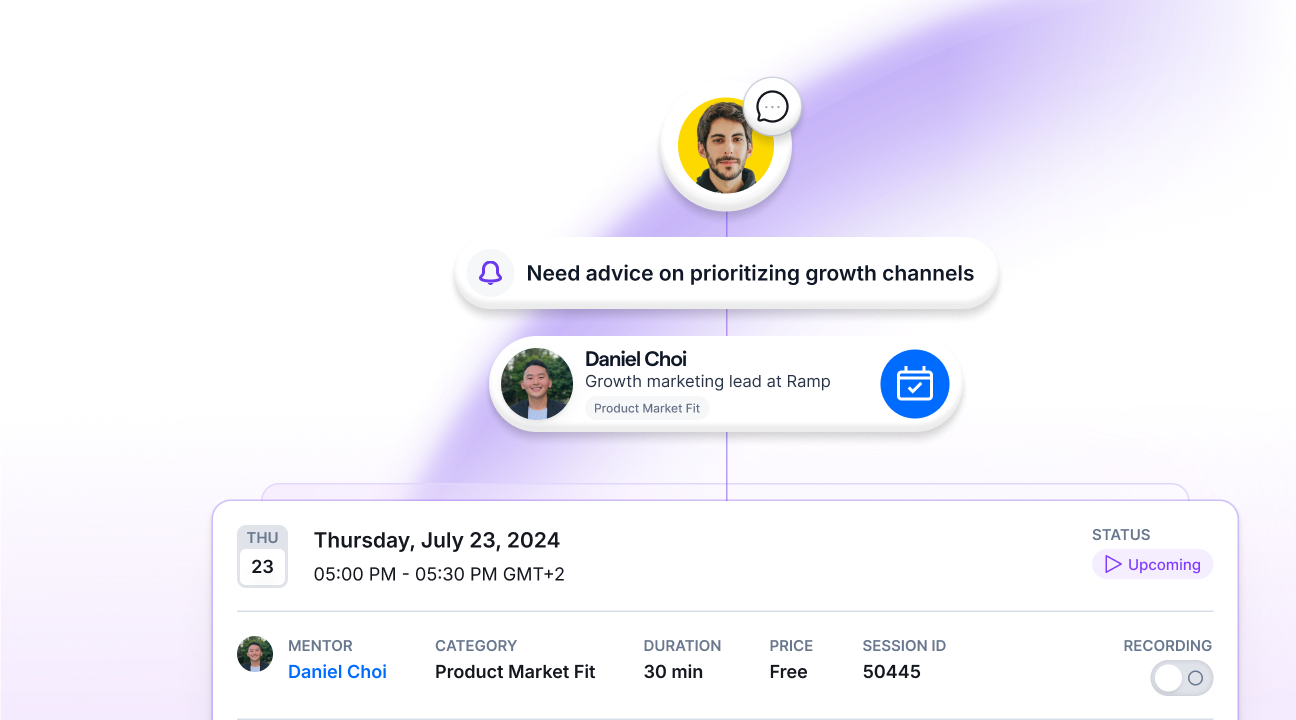

Book Zoom calls with vetted fintech mentors and get personalized advice that's relevant to your situation.

What's our compliance strategy?

Should we offer mobile payments?

How can we reduce transaction fees?

What's our cybersecurity plan?

Should we use AI for insights?

Should we partner with banks?

What's our customer acquisition plan?

How do we ensure data privacy?

Should we focus on blockchain?

What's our go-to-market strategy?

How do we comply with regulations?

Should we offer financial advice?

How do we optimize user onboarding?

Should we build our own platform?

All your questions about mentorship, answered

Why should I talk to an fintech mentor?

Navigating the world of fintech can feel like diving into a sea of possibilities and complexities all at once. It’s not just about understanding the tech; it’s about knowing how to apply it strategically. A fintech mentor brings invaluable firsthand experience and insights that textbooks can’t provide—they’ve tackled challenges, seized opportunities, and can guide you through the maze of regulations, innovations, and market dynamics.

Mentors can introduce you to their networks, opening doors to collaborations and partnerships you might not find on your own. They’ve likely seen trends come and go, offering foresight that’s pure gold in such a fast-moving industry.

While there are many DIY guides and success stories, theory often falls short in practice. Wouldn’t you rather have confidence in every decision?

You can. Just talk to an Fintech mentor.

What can an fintech mentor do for me?

A fintech mentor can offer a wealth of expertise to help you navigate the complexities of the fintech industry. They can guide you through crucial areas such as:

- Product Development: Helping you refine fintech solutions that are not only innovative but also meet regulatory standards and customer needs.

- Technology Integration: Assisting in the implementation of cutting-edge technologies to improve financial services and user experiences.

- User Experience: Ensuring your platforms are user-friendly and secure, enhancing interactions for both clients and businesses.

- Market Strategy: Developing effective plans to reach your target audience, whether through digital marketing, partnerships, or other strategic initiatives.

Mentors also provide strategic marketing advice to boost your brand’s visibility and credibility in the competitive fintech landscape.

Moreover, they can also facilitate networking opportunities, connecting you with industry leaders and potential collaborators to foster growth and sustainability in your fintech ventures.

Should I talk to a fintech mentor now?

If you’re starting a new fintech business, your head is probably spinning from a never-ending list of “to-dos.” With so much to cover to get your business up and running, it can be difficult to know where to start!

If you haven’t started yet, a mentor can guide you through:

- Product Development: Helping you refine and innovate your fintech solutions.

- Technology Integration: Choosing and implementing the right technologies for efficiency and security.

- Operational Efficiency: Streamlining processes and optimizing team roles.

- Marketing Strategy: Crafting effective plans to boost your brand’s visibility and reach.

- Networking: Connecting you with industry leaders and potential partners for collaboration and growth.

If you’re already operating, a mentor can help you when:

- Struggling with product development

- Facing technology integration challenges

- Needing to streamline operations

- Developing a robust marketing strategy

- Seeking networking opportunities

Even seasoned entrepreneurs can benefit from a mentor’s insights to navigate the unique challenges of the fintech industry, ensuring sustainable growth and success.

So why wait?

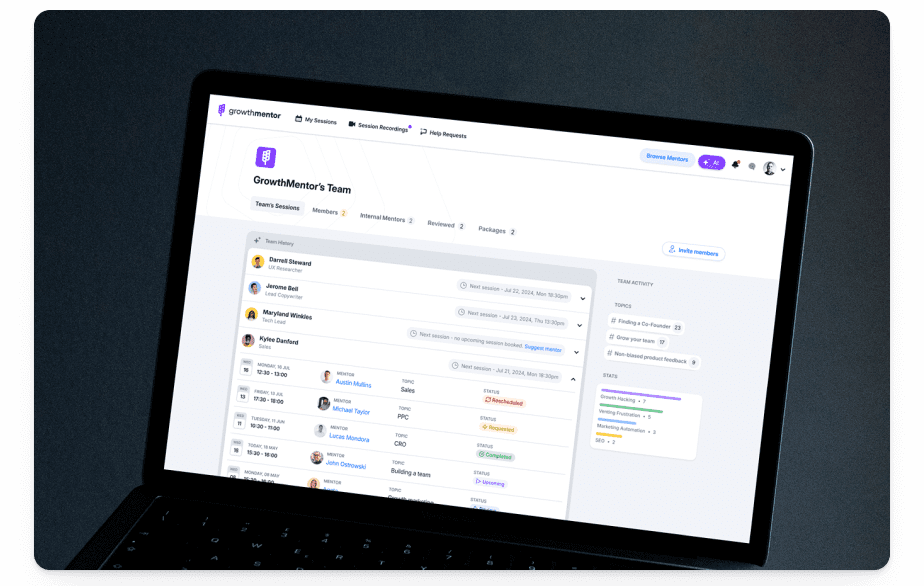

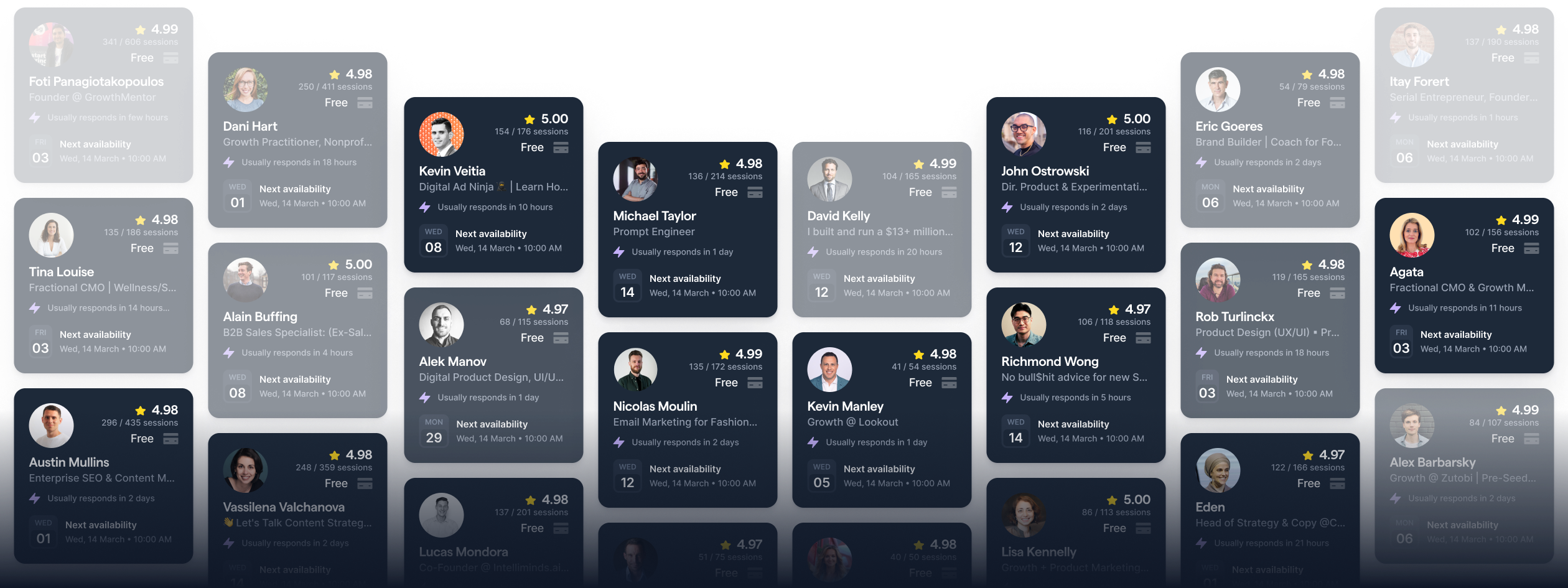

Join the most uplifting community on the internet

Frequently asked questions

Our mentors are the top 3% of their field. Every mentor goes through a strict double-vetting process to ensure they’re the best of the best.

But, when vetting, we also look at an applicant’s soft skills:

- Does this person have the patience to hop on a call with a total newbie?

- Can they hang with someone who is even more advanced than themselves in a certain area?

We’re looking for humility, kindness, and warmth.

These traits are what set Growth Mentors apart from other “gurus”.

They want to share their knowledge and help.

The short answer? Because they want to help people.

The long answer? Because…

- They enjoy sharing their knowledge

- They learn from their mentees

- They want to be a “force for good” in the business world

- They want to pay it forward

Yep. Purchase a pro plan and you get unlimited calls every month.

GrowthMentor is the only startup mentorship platform in the world where a single flat-rate subscription gets you unlimited access to hundreds of world-class mentors.

No exorbitant per-session fees, – think Netflix, but for 1:1 calls with startup mentors.

Two words: active learning. When your team goes to AI with their problems, they’re often consuming the information, but not applying it.

By talking things through with a mentor, your team members will sharpen their understanding of their challenges and find routes to put the advice into action faster than they could with an AI solution.

Yes. If it’s not for you, simply cancel your membership within 14 days and contact support for a full refund.

Note that refunds are not possible if you’ve breached our terms of service.