Startup Advisor Compensation Methods & Best Practices

Startup advisor compensation

How should I compensate my advisors?

Standard startup advisor compensation is a common question for many startup founders since an advisor is not just another employee in your company. Their work is not measured in deliverables but rather in the company’s success. Therefore, it can be tricky to decide on a suitable package for the labor.

In an ideal world, we’d all have connections with talented and experienced individuals willing to help us for free. Unfortunately, that’s not the case. Mentors and startup advisors expect to be compensated, usually in the form of ownership in your company (equity interest). Equity levels may vary depending on the advisor’s value, level of involvement, and the company’s maturity.

The advisor’s duties might extend from occasional meetings all the way up to being a part-time hands-on member of your team. Once the advisor becomes an investor, their time and experience come for free. Therefore, they share a common interest of wanting your startup to succeed, for which they’re willing to offer their best advice.

In this article, we’ll explore all about advisor compensation startups and how to design an equity package. If you want your startup to grow faster, use Growth Mentor to receive personalized advice with 1:1 mentorship. Choose amongst 400 mentors and get practical advice on how to move forward.

What is a startup advisor?

Startup advisors are paid professionals who consult with founders and executives to guide their company’s direction. These individuals have years of industry experience and sought-after expertise that can be as valuable as gold for new companies trying to find their steps. They sign agreements with startups offering their advice and connections to help with partnerships and revenue growth.

For example, a startup making medical devices could benefit from an expert with connections with academics and government regulators. Likewise, an electric bicycle company trying to break into a new city could use some advice on overcoming obstacles that block their efforts.

In other words, advisors fill in the knowledge gaps, help unpack some issues, and sometimes play the devil’s advocate. This way, they give startups the space to make their own decisions and grow. The difference between advisors and mentors is that they’re usually unpaid and act in an informal capacity. Likewise, consultants play a similar role to advisors, but they’re hired to perform specific tasks and are paid in cash.

Types of advisors

One factor that influences standard startup advisor compensation is the type of advisor you hire for your company. Startup advisors usually fall into one of the following categories:

- Board advisors. They’re usually experienced ex-founders or industry experts who assist in the company’s decision-making. They have a strategic and disciplined way of thinking and help shape the company’s strategy. That’s why their input is sought after, and they’re given a seat on the company’s board.

- General advisors. They might be ex-industry specialists that act as an invaluable source of advice for the company. However, they don’t sit with the rest of the directors on the board because they have less input on the company’s strategic direction.

- Technology advisors. They share their input on the tech sector, implement technology best practices, and might even code themselves. They focus on designing a tech roadmap and shaping the company’s vision in the technology sector.

Related: Learn more about Customer Advisory Boards

Some tips on finding startup advisors

In your efforts to spot startup advisors, you should keep in mind that you’re looking for individuals who aren’t wealthy enough to be investors or have enough time to be employees. However, you don’t just pay them as contractors, but you want them to be genuinely invested in your company’s success, from which they’ll benefit as well.

Start from your own network. Perhaps you’re already collaborating with mentors who proved themselves as valuable and trustworthy partners. So now it’s time to turn them into formal advisors. Or your investors might have connections of their own to help your secure advisor referrals.

Of course, you can always access growth experts from notable companies from a site like Growth Mentor that offer genuine advice 100% tailored to your needs.

However, throughout the process, keep in mind that you shouldn’t add high-profile names to your advisory board just for the sake of it. You might want to impress stakeholders and customers but end up with very busy, hard-to-access professionals who are not there when you need them. Many people simply collect board chairs and the attached stock, only to vanish into thin air for the rest of their duties.

We highly recommend vetting them as if they were another staff member. This might include interviews, reference checks, and ensuring they don’t have conflicts of interest. As a new company, you have every right to put their skills to the test and ensure you’re making the right decision. Audit your advisors’ board every 6 months if necessary, and replace its members as your needs change. After all, top-notch advisors know when it’s time to step down.

What should a startup advisor agreement contain?

Once you find an advisor, you’ll need to sign a carefully-crafted agreement that includes:

- The advisor’s duties & responsibilities

- The duration of the agreement

- Confidentiality & non-disclosure

- Advisor compensation

You also need to set benchmarks for the advisor’s duties, even though their responsibilities will be determined by the nature of the startup and its needs.

You also need to agree on access and availability, especially when founders need immediate advice. So make sure that the advisor is available for a quick call or a fast brainstorm, and they’re not too hard to find.

Why should you compensate advisors?

Apart from offering compensation for their time and expertise, you also want to give advisors some personal motives. So even if they offer to provide their input without compensation, you’ll encourage them to show personal interest if they have a share in the benefits.

In particular, equity compensation works as an alignment between the company’s success and the advisors’ actions. After all, it’s the most agreeable solution since startups are usually cash-strapped at the beginning. Moreover, advisors who don’t put a premium compensation on their time are perhaps not great advisors to begin with.

Cash vs. equity compensation

Startup advisor cash compensation is less appropriate since advisors are not like other employees. Their output is not agreed upon, and their job focuses on sharing their precious thoughts and expertise based on previous experience.

You could say they offer a shortcut to success and prevent your startup from falling into common pitfalls. This way, they give you an invaluable competitive advantage that could translate into significant income and long-term growth.

Of course, some advisors get compensated with salary, equity, both, or neither. It usually comes down to the individual’s preference as well as the type of advisor. Certain factors such as company valuation, time commitment, and their role in the company also fall into the equation.

But as a general rule of thumb, advisors don’t ask for monetary compensation but an equity interest that will rise significantly in value as the startup grows. That’s good for the startup because it might not have enough cash for marketing and operations, especially at the beginning.

Startup advisor equity compensation criteria

The way startups award equity to advisors is by restricting stocks. These are stocks that can’t be sold or transferred for a specific time period and can usually be repurchased from the advisor. Oftentimes, the stocks are subject to a vesting schedule. This means that in case the advisor stops serving the company, they might forfeit their shares.

To decide how much equity the startup will offer to the advisor, you should take into consideration these two important things:

- Added value. The more value an advisor adds to a startup, the more its equity compensation. Of course, not all advisors contribute the same value to a company – some of them might go above and beyond to provide value. For example, they might aid the company’s recruitment process, the customer acquisition tactics, and the overall public relations and connections.

- Company value. A company’s operations and stage of development play a vital role in the startup advisor equity compensation. For example, a technology startup will have higher equity packages than traditional product and service firms. That’s because they’re more scalable, and they add potential value due to their intellectual property.

How much equity to offer?

There’s no one-size-fits-all regarding how much equity you’ll compensate an advisor. The average equity is between 0.5-2% in the form of restricted shares. However, these numbers can be affected by the company’s characteristics as well as how soon the results start to show. For example, adding lower value in an early stage might result in a lower percentage of equity, whereas having immediate results might increase the equity by at least 1%.

An important factor to consider when it comes to startup advisor equity compensation is the time framework. Your advisor’s involvement with your company will possibly extend to a short period. That’s because as your startup grows, your needs will change. But also, the advisor’s availability and circumstances might change too.

So the best course of action is to focus on shorter time horizons of 1-2 years instead of 4. For example, grant them between 0.25% and 1% shares in a two-year vesting schedule with a 3 months cliff. This way, even if the relationship doesn’t work out, you’ll still be able to replace your advisors without losing part of the equity.

The Travis Kalanick method

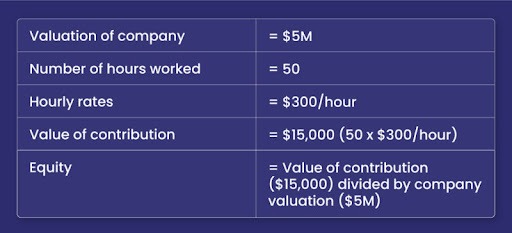

You might have heard about former CEO of Uber and American businessman Travis Kalanick who believed that math is important when deciding on equity shares.

His method has helped thousands of companies create a fair startup advisor equity compensation package with benefits for both advisors and investors. So let’s see how it works!

- Value your business. If you haven’t raised funds yet, you can value your company at $5-10M.

- Estimate the expected hours your advisors will contribute in a vesting period—for example, 1 hour per week or 50 hours per year.

- Add their hourly rates to the equation. If they get paid $300 per hour, they’ll receive $15,000 yearly.

For example, let’s say that your startup is valued at $5M. The advisor you’re looking to hire has an hourly rate of $300, and their total yearly worked hours are 50. So the overall value of their contribution would be (300×50) $15,000. As a result, the equity share would be the contribution value divided by the company value, or 0.3% (15K/5M).

The Guidelines method

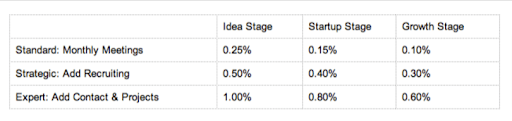

Another method to calculate startup advisor equity compensation is the Guidelines method also known as the FAST agreement (Founder/Advisor Standard Template). It denotes 3 levels of company maturity that ultimately define the advisor-founder relationship: idea, startup, and growth. Moreover, it adds to the equation 3 levels of advisor engagement: standard, strategic, and expert.

For example, if an advisor gets involved in the recruiting process, participates in monthly meetings, and takes a few customers’ calls at the startup stage, they’ll be entitled to 0.80% startup advisor equity compensation. They’ll receive it in the form of stocks, vesting over a two-year timeframe. This allows both parties flexibility in a way that also meets the minimum legal requirements.

Deciding on startup advisor compensation

Advisors are valuable assets for your startup that can offer the right help at the right time. These dedicated allies bring their set of skills and previous expertise to guide your way to growth. Of course, it’s up to you to decide the method you’ll follow to find the standard startup advisor equity compensation. However, we recommend starting with the Travis Kalanick method and using the Guidelines method to see if you’re on the same page.

The equity compensation is a stellar opportunity to align interests and expectations. Remember that having top-notch advisors is a must for your company’s survival, and the more they’re invested, the higher the success. Use Growth Mentor to find targeted advice from people who’ve “been there, done that”. Find your mentor match with filters, schedule a call, and go beyond one-off calls. This is your chance to find clarity on things you’re struggling with and thrive. Browse mentors today!