The 53 Best Startup Accelerators in the World (Sorted by Country)

Unless you’re joining 500 Startups, Y Combinator, or maybe Techstars, you probably shouldn’t be looking at an accelerator as a path to raising a large funding round. Perhaps compete in a startup competition for some free money? 😉

Most accelerators have started to search for niches and verticalize in order to focus more on facilitating partnerships. If you’re a B2B company in an industry with long sales cycles, high barriers to entry, or large incumbents that your want to work with, it can certainly be worth giving up equity to join these more specialized programs if they fit with your strategy.

That being said, keep a lookout for equity-free incubators, launchpads, and accelerator programs (often run by corporates to find startups to partner with).

They often have free office space, hosting credits, and other resources at their disposal that can help you extend your runway.

Not sure which to apply to?

We’ve rounded up the internet’s most comprehensive list of startup accelerators in 2023, categorized by country.

Enjoy!

The United States of America

Y Combinator

Why you should apply to Y Combinator:

You’ve definitely heard of Y Combinator: founded in 2005, it’s practically one of the oldest startup incubators. So far they’ve funded over 3,500 startups, with household names such as Airbnb, Dropbox and Reddit among them. The Y Combinator community numbers more than 9,000 founders and their portfolio of companies has a combined valuation exceeding $1 Trillion.

If your startup is early stage, you can take advantage of Y Combinator’s biannual 3-month program, during which time you will relocate to Silicon Valley to work closely with their team. The companies will get the opportunity to get their offering in shape and get on a path to growth by targeting further investments.

KEY INFORMATION

- When it was founded: 2005

- Location: Silicon Valley, California, USA

- How to apply: Sign up and fill in your application here

- What they give: $500,000 in every company, $125,000 in exchange for 7% equity and $375,000 on an uncapped safe with a Most Favored Nation provision

- Industry focus: No specific industry focus

- Startups funded: More than 3,500

- Exits: 454

- Exit value: $6,076,233,100

- Total funding raised: $34,087,493,743

- Companies: More than 3,500, including Amplitude, DoorDash, and Stripe

- Startup Directory, Twitter profile

Brian Chesky, Founder of AirbnbAt YC, we were challenged to do things that don’t scale — to start with the perfect experience for one person, then work backwards and scale it to 100 people who love us. This was the best piece of advice we’ve ever received.

AngelPad

Why you should apply to AngelPad:

Based in New York and San Francisco, the accelerator program has worked with more 150 companies with an average funding of 14 million USD for each. They have a really impressive track record, having been ranked as the Top U.S Accelerator by MIT’s Seed Accelerator Benchmark every year since 2015.

One of their many notable alumni companies, Postmates, have raised $578,000,000 to date, was last evaluated for $1.9 billion and filled IPO this year.

Every 6 months, they select 15 teams for their intensive 3-month program. The applications are certainly many, but if you are on the lucky one you will get funding, mentorship, as well as prepping in a wide range of subjects such as product market fit, getting validation, preparation for fundraising and more. Mostly, you will have the opportunity to become a part of their lively community of founders and form connections to investors.

KEY INFORMATION

- When it was founded: 2010

- Location: San Francisco, California / New York, New York

- How to apply: Applications are open, apply here

- What they give: $120,000 in return for 7% equity

- Industry focus: No specific industry focus

- Startups funded: 179

- Exits: 37

- Exit value: $918,250,000

- Total funding raised: $2,200,000,000

- Companies: Their Alumni include Fieldwire, Buffer and Postmates

- Startup Directory, Twitter Profile

Eddie Siegel Co-Founder at TapfwdBest experiences of my Life!

I could write a book about all of the things I learned from Thomas. AngelPad was one of the best experiences of my life, and I’d do it again in a heartbeat.

Launchpad LA

Why you should apply to Launchpad LA:

If you and your team live or are willing to relocate to LA, Launchpad LA may very well be the best choice for your technology startup. Their four-month accelerator program offers funding, free office space, an extensive network of mentors, investors and advisors, as well as various cool free perks.

Launchpad LA is a very flexible venture in how they choose what companies to work with. They’re interested in strong teams with amazing products that need a push and support in the right direction. That could be fundraising, business development, product refinement or any other aspect of the startup growth process.

KEY INFORMATION

- When it was founded: 2009

- Location: Los Angeles, California, USA

- How to apply: They are not accepting applications at this time, but keep an eye on this page

- What they give: $25,000 – $100,000 in exchange for 6% equity, office space and provide access to a massive network of mentors, investors and advisors

- Industry focus: Technology

- Startups funded: 54

- Exits: 14

- Exit value: $185,000,000

- Total funding raised: $140,000,000

- Companies: Some of the Companies funded include Mark 43, Combatant Gentlemen and TrueVault

- Startup Directory, Twitter Profile

PandoDailyThe Top Accelerator in Southern California

Amplify.LA

Why you should apply to Amplify LA:

A California located pre-seed fund, Amplify.LA likes to invest in the early stages of a startup and help technology entrepreneurs build successful and scalable companies. They focus mainly on technology and, in addition to funding, they offer free office space and discounted services, as well as an extended mentor network of experienced thought leaders from various industries. They are also committed to help you raise additional capital during your growth process.

Though they prefer the companies they support to be based in LA, they have invested in startups from other states or even from outside the US.

Some of their most notable portfolio companies include Mapsense which was acquired by Apple and Bitium which was acquired by Google.

KEY INFORMATION

- When it was founded: 2011

- Location: Los Angeles, California, USA

- How to apply: Contact them here

- What they give: $50,000 – $150,000 in seed funding for a 5% – 15% stake, office space and other services, and access to their mentor network

- Industry focus: Technology

- Startups funded: 153

- Exits: 39

- Exit value: $57,900,000

- Total funding raised: $585,983,591

- Companies: More than 150, including Abstract, Advekit and Card.com

- Startup Directory, Twitter Profile

AlphaLab

Why you should apply to AlphaLab:

Based in Pittsburgh, PA, AlphaLab is a software accelerator helping early-stage tech companies evolve and grow through their intensive 4-month program. In addition to funding, the program includes an extensive mentorship network and educational sessions.

What sets AlphaLab apart from other accelerators is that they only focus on six to eight startups for each program, which means you will get personalized attention and customized assistance for your startup’s needs.

AlphaLab is a charter member of the Global Accelerator Network (GAN) and one of the first ten accelerator programs worldwide. Over 70% of their companies have raised follow-on funding reaching a total of $150 million. Some of their most notable exits include NoWait (Yelp), Shoefitr (Amazon) and Powered Analytics (Target).

KEY INFORMATION

- When it was founded: 2008

- Location: Pittsburgh, Pennsylvania, USA

- How to apply: Application is open, apply here

- What they give: Up to $50,000 investment in return for 2% equity, plus space and services

- Industry focus: Software

- Startups funded: 154

- Exits: 81

- Exit value: $40,000,000

- Total funding raised: $150,000,000

- Companies: More than 150, including Accel diagnostics, EQUA and Credible Assets

- Startup Directory, Twitter Profile

500 Startups

Why you should apply to 500 startups:

500 Startups is a truly global venture capital firm, with a team of 180+ people based in 27 countries that manage investments across 81 countries. Their mission is to create thriving global ecosystems by discovering talented founders and helping them grow through a 4-month seed program.

Their investment team and mentor network has operational experience at companies such as PayPal, Google, Facebook, Instagram, YouTube, Yahoo, LinkedIn, Twitter, and Apple.

Twilio, Canva, and Udemy are just a few of the 2,600+ technology startups they’ve invested in over the years, with 4 global funds and 15 thematic funds dedicated to either specific geographic markets or verticals. You’ll be in good company!

KEY INFORMATION

- When it was founded: 2010

- Location: San Francisco, California

- How to apply: Apply to their 4-month seed program in San Francisco, here

- What they give: $150,000 in exchange for 6% equity. You also get access to the community, investors, and mentors, free office space, support, and connections. Note that there is a $37,500 fee to participate in the program

- Industry focus: No specific industry focus

- Startups funded: 2,600+

- Exits: 1,135

- Exit value: $21,300,000

- Total funding raised: $2,474,708,397

- Companies: Over 2,600, including Canva, Reddit and Talkdesk

- Startup Directory, Twitter Profile

Anjani Vedula, MBA – Berkeley Haas (Formerly at IFC)VC Unlocked helped me grow my confidence in evaluating early stage startups because most of my investments at IFC were later stage startups (Series B and beyond). I learned about the importance of investing in teams with relevant “superpowers” and in products with a large addressable market. I also became more confident in my own “superpower” as an investor, and was able to hone my personal Investment thesis.

RevUp

Why you should apply to RevUp:

Is your company B2B or B2C, moving fast and generating revenue (around 500K-3M)? Then you should consider applying for a company screening with RevUp. The Rhode Island based capital firm has more than 10 years of experience and has invested in more than 130 companies.

They offer equity-free, non-dilutive cash investment based on revenue (you return a small percentage from your company’s revenue over time).

Apart from cash, RevUp also offers human resources and support, as well as access to their in-house growth team and experienced management team. The RevUp team selects companies on a rolling basis by conducting monthly screening meetings.

KEY INFORMATION

- When it was founded: 2009, but the company evolved to its current form as RevUp in 2015

- Location: Providence, Rhode Island, USA

- How to apply: Complete the pre-screening form here

- What they give: $100,000-$250,00 cash investment, equity free, with a 36-month return period with revenue royalty ranging from 4-8%

- Industry focus: No specific industry focus.

- Startups funded: 130+

- Exits: 6

- Exit value: $14,000,000

- Total funding raised: $67,913,534

- Companies: More than 130, including Cortex, Data Society and Gather Voices

- Startup Directory, Twitter Profile

Portland Incubator Experiment (PIE)

Why you should apply to Portland Incubator Experiment (PIE):

Portland Incubator Experiment, also known as PIE, is a very interesting case: throughout the years they have been an early-stage startup accelerator; a community hub and co-working space; a consultant for a global incubator and accelerator programs. They have now grown into a flourishing ecosystem that nurtures and mentors startups from all over the world, on a mission is to “build better founders”, sharing successes and failures to inspire and educate founders everywhere. They are even writing a book (called, “PIE Cookbook”) to that extent.

What started as a conversation between a creative advertising agency and the Portland startup community, PIE now enables organizations (from government and corporations to educational institutions) to collaborate with startup communities effectively and beneficially.

As a participant in their program, you get funding and office space to spend up to nine months in Portland and learn from the extensive PIE network, including other startups-in-residence, alumni, mentors and thought leaders.

KEY INFORMATION

- When it was founded: 2011

- Location: Portland, Oregon, USA

- How to apply: Sign up to the newsletter here, to receive updates

- What they give: $20,000 in exchange for 6% equity

- Industry focus: No specific industry focus

- Startups funded: 42

- Exits: 26

- Exit value: $5,600,000

- Total funding raised: $190,318,989

- Companies: Some of the companies founded are Chroma, Roons and Edify

- Startup Directory, Twitter Profile

Upwest Labs

Why you should apply to Upwest Labs:

Whatever stage your product is in, whether you’re looking to break into the US market or you already have an established presence and whether you’ve had previous seed funding or not, Upwest Labs could be interested in your company.

The Silicon Valley-based seed fund has a hands-on approach, to help the companies they support scale quickly and effectively and succeed to later stages. Upwest Labs provides ongoing mentorship, follow-on funding and support for a handful of companies each year, to be able to give them their full attention.

Apart from their initial investment and an office in Silicon Valley, Upwest Labs is willing to invest up to 1 Million USD throughout the course of your startup’s life and give you the connections you need to thrive in Silicon Valley and beyond.

KEY INFORMATION

- When it was founded: 2012

- Location: Silicon Valley, California, USA

- How to apply: Send them an email

- What they give: $17,500 equity-free

- Industry focus: No specific industry focus

- Startups funded: 80+

- Exits: 24

- Exit value: $3,000,000

- Total funding raised: More than $2,000,000,000

- Companies: More than 80, including HoneyBook, CuberX and SlickLogin

- Startup Directory, Twitter Profile

Rock Health

Why you should apply to Rock Health:

Rock Health lives on the intersection of healthcare and technology and the companies it supports aim to improve the healthcare system. They are the first venture fund dedicated to digital health, aiming to create a positive impact on the industry.

Their portfolio companies tackle issues such as mental health, quitting smoking, diabetes, and hospital administration among others.

Rock Health are early-stage investors seeking to invest in companies focused on problem-solving and support them in growing and becoming fully fledged businesses. They have built a community of founders that give back to the system and support each other.

KEY INFORMATION

- When it was founded: 2010

- Location: San Francisco, California, USA

- How to apply: Apply to join their portfolio here

- What they give: Investment in seed rounds as well as participation in early venture rounds and the option to work from their SF offices

- Industry focus: Healthcare

- Startups funded: 105

- Exits: 22

- Exit value: $500,000

- Total funding raised: More than $75,000,000,000

- Companies: More than 100, including InsightRX, Brightline and Equip

- Startup Directory, Twitter Profile

Capital Factory

Why you should apply to Capital Factory:

Capital Factory supports startups out of Austin, Texas. They offer mentoring for startups with expert mentors on a weekly basis, as well as a 6-month accelerator program that provides hands-on help to startups to raise funding and increase growth.

Capital Factory is also a significant coworking space that’s currently home to hundreds of startups, providing access to their mentor network of 150+ experts and presence in startup-related events (think exclusive VIP lounge access in SXSW).

Capital Factory places a lot of value on training and education: they offer a wide-ranging curriculum on topics such as customer acquisition, fundraising, business development, and company strategy.

KEY INFORMATION

- When it was founded: 2009

- Location: Austin, Texas, USA

- How to apply: Check application opportunities here

- What they give: $20,000 in exchange for 1% equity and rights to invest in your next big round of funding

- Industry focus: Software, hardware, and innovation

- Startups funded: 712

- Exits: 447

- Exit value: $500,000

- Total funding raised: $109,282,500

- Companies: Some of the companies funded include Bonfire, Advanced Scanners and CloudARK

- Startup Directory, Twitter Profile

Kristyl Gomes - CEO, appVuze, IncWe’ve had a very positive experience as a Capital Factory Accelerator company. One of CF’s biggest strengths is their large mentor network and we’ve gladly taken advantage of this by seeking advice from many mentors.

Forum Ventures

Why you should apply to Forum Ventures:

Starting a company is really hard – we understand that first hand. As former SaaS founders and operators, we know the importance of having capital, support, community, and an outside perspective on this journey.

Since 2014, we’ve worked with 400+ SaaS founders. We know how to help founders build a sustainable business by acquiring customers and raising additional capital. Once we invest in a company, we walk hand in hand with founders as a fractional co-founder during this crucial part of your journey. We start by setting a joint goal, then we work backwards on the proof point.

Once the proof points are hit, we help craft your fundraising narrative, and take you out to raise capital. We do this because early-stage investors look for a strong team, traction and narrative. By focusing on these areas with our founders, we’ve achieved an average fund-through-rate of 65% and NPS of 70.2.

KEY INFORMATION

- When it was founded: 2014

- Location: New York, San Francisco, Toronto

- How to apply: By filling in the application here

- What they give: (Accelerator) $50k or $100 for 5% or 7.5% / (Seed) $250-750k funding, Equity % depends on round dynamics

- Industry focus: B2B

- Startups funded: 300+

- Total funding raised: $600M Follow-on funding

- Companies: Some of the companies funded include Firstbase, Fireflies.ai, Private AI and Balloon

- Twitter Profile: https://twitter.com/forumventures

JumpStart Foundry

Why you should apply to JumpStart Foundry:

If your startup is in the healthcare industry and you want to make a difference, then look no further. JumpStart Foundry’s mission is simple: to support early-stage healthcare companies and make the world better, one company at a time.

JSF connects companies with industry stakeholders, offers consulting on strategy and marketing and advises them on talent and growth. Apart from funding, cohort members of the JSF program also receive exclusive perks, connections, and knowledge from leading business minds in Nashville.

You can apply year-round: two rounds of investment are made every April and November.

KEY INFORMATION

- When it was founded: 2010

- Location: Nashville, Tennessee, USA

- How to apply: By filling in the application here

- What they give: $150,000 Safe with a 2 or 4 Million valuation cap, in exchange for a 7.5% equity. Note that there is a participation fee of 50K USD

- Industry focus: Healthcare

- Startups funded: 171

- Exits: 14

- Exit value: Data not available

- Total funding raised: $26,530,026

- Companies: Over 170, including Care.it, Ruth Clinic and CureMint

- Twitter Profile: https://twitter.com/jsfoundry

Entrepreneurs Roundtable Accelerator

Why you should apply to entrepreneurs roundtable accelerator:

Entrepreneurs Roundtable Accelerator (ERA) is New York City’s largest accelerator program with a mentor network spanning more than 500 expert investors, technologists, product specialists, marketers, customer acquisition strategists, sales executives, and more, across all major industries. They accept companies from all over the world and offer office space in their location in the heart of Manhattan for the duration of the program.

ERA runs two four-month programs every year, aiming to provide hands-on help to early-stage startups. Apart from funding and office space, expect to also get benefits from ERA partners, such as credits from Microsoft, Amazon Web Services and Google Cloud Platform.

KEY INFORMATION

- When it was founded: 2011

- Location: New York, New York, USA

- How to apply: Check this page to see if there are open applications

- What they give: $150,000 in exchange for 6% equity and the potential for follow-on funding, as well as free office space

- Industry focus: Technology

- Startups funded: 275

- Exits: 91

- Exit value: Data not available

- Total funding raised: More than $1,700,000,000

- Companies: Some of the companies funded include Moon, flow and Popwallet

- Startup Directory, Twitter Profile

Blue Startups

Why you should apply to blue startups:

Blue Startups is a Top 20 Accelerator in the US and a member of the Global Accelerator Network. Their mentor network numbers 140 members reaching from Asia to Silicon Valley.

Based in Honolulu, Hawaii, Blue Startups aims to help scalable technology companies compete on a global scale. Uniquely located between Asia and North America, Blue Startups is a hub of activity in Hawaii and offers an intensive, mentor-driven accelerator program with 10 participants in each session. You will have to spend 13 weeks in Hawaii, taking advantage of their coworking space (and the beach), perks from partners such as Facebook and Hubspot as well as of funding up to 350K in total.

They are mostly interested in scalable companies in sectors such as travel, gaming, impact and enterprise tech.

KEY INFORMATION

- When it was founded: 2012

- Location: Honolulu, Hawaii, USA

- How to apply: Check out this page to see when applications open

- What they give: Up to $100,000 in each company that comes through the program which is splitted in $25,000 up-front investment, space, education, perks, mentorship and business development services and up to $75,000 in follow on funding per company, based on milestones met during program

- Industry focus: Scalable technology companies

- Startups funded: 117

- Exits: 49

- Exit value: Data not available

- Total funding raised: $70,373,545

- Companies: More than 100, including Mount, Volta and FloWater

- Startup Directory, Twitter Profile

Portland Seed Fund

Why you should apply to Portland Seed Fund:

If you are located in the Pacific Northwest region, the Portland Seed Fund acts as the bridge connecting you with Oregon’s startup ecosystem, mentors, advisers, capital, customers and employees.

They offer an accelerator program focused on important aspects of the startup journey, from growth and scaling, financial planning and controls, building a great team and culture, and accessing growth capital.

Since 2011, PSF has invested $8 million in more than 200 companies who have gone on to raise more than $1.5 billion from other sources. They focus on locality and diversity, as more than half of PSF companies have a woman or person of color on the founding team (and more than a third have a female CEO).

KEY INFORMATION

- When it was founded: 2011

- Location: Portland, Oregon, USA

- How to apply: Contact them here

- What they give: $50,000 equity-free

- Industry focus: No specific industry focus

- Startups funded: 215

- Exits: 60

- Exit value: Data not available

- Total funding raised: $70,222,879

- Companies: More than 200, including Streem, Bright.md and Cozera

- Startup Directory, Twitter Profile

Kevin Long, CEO, The DyrtThe investment was great – with a network that was even better.

NFX

Why you should apply to NFX:

NFX is focusing first and foremost on founders, entrepreneurs, and people — aiming to provide a unique point of view in the startup ecosystem. The Palo Alto-based fund works closely with the companies under its ‘Guild’ (they dislike the word ‘Portfolio’) to build a quality experience for founders and equip them with techniques for growth.

They offer a variety of programs tailor-made for companies at various stages of development, from seed and early A startups, as well as companies in earlier stages.

With impressive ‘Guild members’ such as Lyft, Patreon, and Flickr, they’ve created a community that becomes stronger with each new company that is added.

KEY INFORMATION

- When it was founded: 2015

- Location: Palo Alto, California, USA

- How to apply: Check their website here on ways to contact them

- What they give: $120,000 in exchange for 5% equity

- Industry focus: No specific industry focus

- Startups funded: 252

- Exits: 99

- Exit value: More than $10,000,000,000

- Total funding raised: $14,000,000,000

- Companies: More than 250, including Radius, ribbon and PayEm

- Startup Directory, Twitter Profile

SixThirty

Why you should apply to SixThirty:

Did you know that St. Louis is one of the largest financial services hubs in the United States? It would make sense then that SixThirty, an accelerator specializing in FinTech companies, would make the city it’s home.

SixThirty invests in 8-14 FinTech startups each year, mainly targeting late-seed stage companies that have a product and have started to earn revenue. The selected companies take part in an 8-week intensive business development program (at least you and other founding members will have to be in St. Louis, if not your whole team) and receive hands-on training, mentoring and networking opportunities.

If your startup is in FinTech and provides software in areas such as Payments / Processing, Security / Fraud Solutions, Regulatory / Compliance Solutions, Big Data and Analytics, Lending, Asset / Wealth Management, it’s worth looking into SixThirty.

KEY INFORMATION

- When it was founded: 2013

- Location: St. Louis, Missouri, USA

- How to apply: Find information about dates and apply here

- What they give: Up to $250,000 in exchange for equity that varies but is typically less than 10%

- Industry focus: FinTech

- Startups funded: 73

- Exits: 32

- Exit value: Data not available

- Total funding raised: $90,038,274

- Companies: Some of the companies funded include Phylum, Bridge and TCare

- Startup Directory, Twitter Profile

Forum Ventures

Why you should apply to Forum Ventures:

Forum Ventures, former known as Acceleprise, was funded in 2012 and has since been working with over 450 B2B SaaS founders in creating one of the largest, most supportive and deeply connected communities in SaaS.

They have helped over 250 pre-seed & seed stage investments and know what it takes to build successful B2B SaaS startups. They offer personalized, hands-on support, wherever you are in the early founder journey.

At the end of each program, companies can participate in their investor week. This format connects their founders with top SaaS investors that opt in to meet with them, and provides an opportunity to book dozens of meetings with their investor network of over 3,000 seed stage VCs, angels, and family offices.

KEY INFORMATION

- When it was founded: 2012

- Location: San Francisco, California, USA (they also have a location in NYC and Toronto)

- How to apply: Fill in your application here

- What they give: $100,000 for 7.5%

- Industry focus: B2B SaaS

- Startups funded: 250+

- Exits: 86

- Exit value: No data available

- Total funding raised: More than $600,000,000 in follow-on funding

- Companies: More than 250, including Indio, Channel 19 and CoProcure

- Startup Directory, Twitter Profile

Sam Dundas, CoFounder & CEO, Bloom AIForum was the fractional cofounder that helped us refine our product, and calibrate our vision to resonate with the right investors to raise a Seed. With all the ups and downs in the early days, having the Forum team in our corner helped us keep up momentum and execute to the best of our ability.

Boost VC

Why you should apply to Boost VC:

Boost VC is a Silicon Valley-based pre-seed fund, with a mission to make sci-fi a reality. Their 3-month accelerator program is focused on tech startups with a passion for solving problems using cutting edge technology. They also have a pre-seed fund.

Boost VC has worked with startups from over 30 countries. If you become one of them, they will offer funding, housing and working space for the duration of the program, as well as mentorship, resources, and connections.

KEY INFORMATION

- When it was founded: 2012

- Location: Silicon Valley, California, USA

- How to apply: Contact them here and get notified when the next accelerator application opens

- What they give: $100,000-$500,000 in their pre-seed funding program. $10,000 – $50,000 in their accelerator program, as well as office space and optional housing, in exchange for 7% equity (amount can vary depending on the stage of the company)

- Industry focus: Technology, blockchain, augmented reality

- Startups funded: 250

- Exits: 135

- Exit value: No data available

- Total funding raised: $287,283,604

- Companies: Some of the companies funded include Coinbase, Wave and Boomy

- Startup Directory, Twitter Profile

Capital Innovators

Why you should apply to Capital Innovators:

Based in St. Louis, Missouri, Capital Innovators wants to help get your startup to the next level. They offer two classes each year (Spring and Fall), each lasting 12 weeks and offering seed funding and project-based mentorship, networking, office space, and other cool perks. Only five companies are accepted for each class, from hundreds of applications.

Though they accept teams from all over the US and worldwide, they want to make St. Louis a hub for startup activity in the Midwest and they’ve noticed that many teams from out of town choose to make St. Louis their base after completing the program.

During its successful history, the program has consistently been ranked in the top 5% of programs in the United States.

KEY INFORMATION

- When it was founded: 2011

- Location: St. Louis, Missouri, USA

- How to apply: Contact them here to apply for the Accelerator Program and CI’s team will contact you to discuss your specific goals

- What they give: $100K investment and 20% discount, which equates to approximately 5% – 10% of the company upon conversion. In addition, participation in the accelerator requires a $50K program fee, which will be paid out of the proceeds of the $100K investment

- Industry focus: No specific industry focus

- Startups funded: 135+

- Exits: 40

- Exit value: No available data

- Total funding raised: More than $400,000,000

- Companies: Over 135, including Beam, CarServ and Verb

- Startup Directory, Twitter Profile

The Alchemist Accelerator

Why you should apply to the Alchemist Accelerator:

If your venture aims to get its revenue from enterprises (as opposed to consumers), then The Alchemist Accelerator wants to hear from you. It’s a venture-backed initiative that focuses on accelerating the development of enterprise-monetizing ventures.

Its six-month program is limited to 25 teams and takes place in the San Francisco Bay Area where several co-working spaces are available to participants. During the program you will get the opportunity to access the accelerator’s trusted network of customer prospects, feedback coaches for fundraising and mentors who will help develop your company to reach customers and increase sales, as well as secure funding.

The best part? You can apply even if you don’t have a specific idea. You can discuss your thoughts in your application and you will still be considered for the program.

KEY INFORMATION

- When it was founded: 2012

- Location: Silicon Valley, California, USA

- How to apply: Next application deadline is November 4th, so apply here

- What they give: $36,000 in exchange for 5% equity

- Industry focus: Enterprise-monetized ventures

- Startups funded: 378

- Exits: 160

- Exit value: No data available

- Total funding raised: $1,200,000,000

- Companies: More than 350, including Marvel Carbon, DCVC and Menlo

- Startup Directory, Twitter Profile

MuckerLab

Why you should apply to MuckerLab:

Instead of the usual accelerator process that culminates to a demo day, MuckerLab promises a company-building period of a year or “as long as it takes”.

They work with only ten to twelve companies per year and focus on them for as long as necessary to ensure that each company evolves and grows to achieve funding. They have a hands-on, boutique approach that means that they can give a great deal of attention to the startups they work with. It’s definitely not accidental that they were ranked number two accelerator in the US, since they have achieved impressive success rates and founder satisfaction scores.

Mucker Lab focuses on investing in seed and pre-seed companies in internet software, services, media ventures, as well as in enterprise, fintech, B2B and consumer products.

KEY INFORMATION

- When it was founded: 2012

- Location: Santa Monica, California, USA

- How to apply: Accepting applications for 2022, you can apply here

- What they give: $21,000 in exchange for 7% equity

- Industry focus: No specific industry focus

- Startups funded: 222

- Exits: 17

- Exit value: No data available

- Total funding raised: More than $8,000,000,000

- Companies: More than 200 including Ardius, honey and UpKeep

- Startup Directory, Twitter Profile

gener8tor

Why you should apply to gener8tor:

Connecting not just startups and entrepreneurs but also artists and musicians with investors, universities and corporations, gener8tor is quite unique in its approach which includes pre-accelerators, accelerators, corporate programming, conferences, and fellowships.

As an accelerator, they invest in only five companies per program and focus on high-growth startups, including software, IT, web, SaaS, life science, MedTech, e-commerce and hardware, which means that if you are selected in one of their programs that take place three times a year, you will get a concierge experience.

The accelerator programs last 12 weeks and apart from investment, your company will also receive support to grow through the platform’s network of mentors, technologists, corporate partners, angel investors, and venture capitalists.

KEY INFORMATION

- When it was founded: 2012

- Location: They have three locations (Madison, Milwaukee, Minnesota) in Wisconsin, USA

- How to apply: Browse the programs here to learn more and fill out an application to apply for an upcoming gener8tor program

- What they give: $100,000 investment in return for 7.5% equity, using a Simple Agreement for Future Equity (SAFE)

- Industry focus: Software, IT, web, SaaS, life science, medtech, e-commerce and hardware

- Startups funded: 175

- Exits: 63

- Exit value: No data available

- Total funding raised: $154,976,515

- Companies: More than 150, including Cheddah, Wooven and SpanDeX

- Startup Directory, Twitter Profile

DreamIT Ventures

Why you should apply to DreamIT Ventures:

Dreamit Ventures is an early seed fund and accelerator, targeting startups with revenue or pilots that are ready to take the next step and scale.

They offer programs mainly in HealthTech, SecureTech, and UrbanTech, and will help you directly access investors, corporate contacts, and thought leaders.

Their programs help startups acquire new customers, hone their go-to-market strategy, and raise capital. Dreamit is a hybrid accelerator model, which means that you can participate in the 14-week program both virtually and in person.

KEY INFORMATION

- When it was founded: 2008

- Location: Delaware, USA & Israel

- How to apply: Applications for their Fall 2022 cohort are open, you can apply here

- What they give: $20,000 in return for the right to invest in your next round with a 20% discount

- Industry focus: HealthTech, SecureTech, UrbanTech

- Startups funded: 384

- Exits: 41

- Exit value: $397,000,000

- Total funding raised: $862,127,626

- Companies: More than 350, including Eko, GraphWear and Cloudmine

- Startup Directory, Twitter Profile

Techstars

Why you should apply to Techstars:

The Techstars Worldwide Entrepreneur Network helps founders and their companies grow by connecting with a wide network of peers, experts, mentors, investors, corporate partners, among others. The Techstars portfolio includes more than 3,300 companies and they currently run 47 mentorship-driven accelerators in over 15 countries. You will surely find a program that fits your needs.

They offer startup programs, mentorship-driven accelerator programs, corporate innovation partnerships and, of course, their Venture Capital Fund which fuels success by investing in the most innovative companies.

Erik Bullen - Techstars Mentor and Angel InvestorTechstars is one of the top global accelerators. Reach is global with 46+ geographic and industry sector specific programs, while access to mentors, investors, and customers is unprecedented. Most importantly, people care and take the #givefirst mentality seriously

When you join a program you also get lifetime access to Techstars resources worldwide network, a special 90-day Techstars mentor-based Accelerator program with personal mentorship and office space, access to over $300k of cash equivalent hosting, accounting and legal support, Demo Day exposure and other investor connections.

Some of its most notable portfolio companies include ClassPass, Digital Ocean and Contently. Here’s a list of 15 notable exits, specifically from the super successful Boston Techstars program.

KEY INFORMATION

- When it was founded: 2006

- Location: They have presence in over 15 countries

- How to apply: You can see the programs currently open for applications or submit a general interest form here

- What they give: A $100,000 convertible note, out of which TechStars contributes $20,000 in return for 6% equity

- Industry focus: Mostly focused on technology-oriented companies.

- Startups funded: 3,547

- Exits: 269

- Exit value: $3,546,800,000

- Total funding raised: $24,400,000,000

- Companies: More than 3,500, including DigitalOcean, Grove and Alpha Exchange

- Startup Directory, Twitter Profile

Startupbootcamp

Why you should apply to Startupbootcamp:

Startupbootcamp organizes ultra-focused and intense 3-month programs in various cities, targeting specific industries such as FinTech, Media, Commerce, FoodTech, FashionTech, and others.

Their aim is to support early-stage founders to rapidly scale their companies by tapping into their extensive and international network of over 2,000 alumni founders, mentors, partners, and investors.

Following a thorough selection process, successful participants get the opportunity to accelerate their business and get experience in a short period of time, as well as leverage mentoring and connections to targeted industry insiders.

KEY INFORMATION

- When it was founded: 2010

- Location: Presence in many cities worldwide

- How to apply: Different programs have different application timeframes and usually accept applications for approximately 3 months every year. Check the website to see which programs are currently open

- What they give: Each 3-month program comes with €15,000 for 6-8% equity, €450,000+ in partner services and 6 months of free collaborative office space

- Industry focus: Several different programs in different cities, including FinTech, Media, Commerce, FoodTech, FashionTech, and more

- Startups funded: 1,085

- Exits: 22

- Exit value: No data available

- Total funding raised: €1,380,000,000

- Companies: More than 1,000, including Aiden, CyberCentric and RozieAI

- Startup Directory, Twitter Profile

Charlie and Dave, Co-founders of LoyaltylionStartupbootcamp proved invaluable. They have an amazing network and connected us with every investor in our seed round.

Orange Fab

Why you should apply to Orange Fab:

A sub-organization of Orange, the French telecommunications corporation, Orange Fab is a fellowship program with innovation at its forefront that aims to connect late-stage startups to corporations. They’re aimed mainly at US-based startups with an existing product but don’t worry if you’re not in the States: they also have a presence in 15 other countries that operate independently.

Its 12-week Fast Track program is based in San Francisco and comes with a great range of benefits such as office space, access to events and personalized sessions with corporate decision makers and support from Silicon Valley mentors.

They describe themselves as industry agnostic; they are looking for true innovation and interesting technologies that can be meaningfully connected with their extensive network of partners.

KEY INFORMATION

- When it was founded: 2013

- Location: San Francisco, California, USA — but they also have 15 other locations around the globe

- How to apply: You can apply to join the Orange Fab platform here

- What they give: $20,000 equity-free funding, support from Silicon Valley mentors, office space, events, plus a business development trip to Paris

- Industry focus: No specific industry focus

- Startups funded: 50

- Exits: 7

- Exit value: No data available

- Total funding raised: $257,695,785

- Companies: Some of the companies funded include Datami, Monzo and Yoco

- Startup Directory, Twitter Profile

Sam De Smet - Co-founder of OTIVThe Orange Fab program supported us both technically and commercially: Together with the Orange experts we made our solutions 5G-ready, and we forged an important commercial partnership on a European level.

Seed Round Capital

Why you should apply to Seed Round Capital:

Seed Round Capital, founded by seasoned entrepreneurs, provides funding, coaching, and operational support to early-stage tech startups. They usually make $25k – $100k investments into pre-seed stage startups that have found initial traction and are generating revenue of at least $3k per month.

In addition to their investment, they help startups complete their funding round through introductions to their personal investor network. They then provide ongoing management guidance, plus access to experts in sales/marketing, recruiting, HR, legal, finance, and accounting.

Although they are based in Houston, they invest in and support startups throughout the US and Canada.

KEY INFORMATION

- When it was founded: 2020

- Location: Houston, Texas, USA

- How to apply: Sign up and fill in your application here

- What they give: $25,000 – $100,000 in a SAFE or convertible note, in exchange for 5% – 7% equity. You also get fundraising support, management guidance and access to their investors, mentors and experts community. Note that there is a $5k monthly fee to participate in the program

- Industry focus: Almost anything tech

- Startups funded: 24

- Exits: None yet

- Exit value: NA

- Total funding raised: $500,000

- Companies: Some of the companies funded include Answerable, Beereaders and KAYA

- Startup Directory, Twitter Profile

United Kingdom

Seedcamp

Why you should apply to Seedcamp:

Based in London, UK, Seedcamp is a European seed fund aiming to identify and invest in early-stage companies addressing global markets and solving big problems through technology.

Seedcamp wants to help you build your business by offering hands-on support in areas such as finding your product market fit, building sales, and marketing capabilities and establishing connections through their global network. In addition to the investment, they offer lifelong access to their support community.

While they mostly focus on European founders, they are open to considering startups from other areas of the world. Some of the most notable companies they have invested in include FinTech companies such as TransferWise and Revolut.

KEY INFORMATION

- When it was founded: 2007

- Location: London, UK

- How to apply: You can apply here

- What they give: £300,000 – £500,000 investment in return for 7.5% equity. They will also co-invest in seed rounds offering up to 2 million GBP, as long as you have a lead investor lined up

- Industry focus: Technology

- Startups funded: 509

- Exits: 59

- Exit value: $137,000,000

- Total funding raised: $7,000,000,000 (yes, billion!)

- Companies: More than 500, including Revolut, hopin and TransferWise

- Startup Directory, Twitter Profile

Jan Hammer, Investor and Partner at Index VenturesSeedcamp has played a critical part in getting the European tech ecosystem to where it is today: thriving with a new wave of global tech players emerging. Seedcamp has been instrumental in getting off the ground some of the Europe’s most successful startups, coaching hundreds of founders and execs, and helping to create the best possible environment for the most ambitious entrepreneurs.

Ignite

Why you should apply to Ignite:

One of Europe’s leading accelerator programs, Ignite (also known as Ignite100) has offered many programs across several cities in the UK since their founding in 2011, having invested in more than 150 companies. They are also backed by the European Union and partnered with Google, so you know you are in good hands.

Their pre-accelerator (three months) and accelerator (six months) programs will support you from the idea stage through to raising a Series A and building a scalable company, all the while offering mentoring from experienced entrepreneurs and networking.

You can apply to Ignite even if you are not from the UK as long as you are willing to relocate there and register your company as a UK Limited Company.

KEY INFORMATION

- When it was founded: 2011

- Location: Newcastle upon Tyne, UK

- How to apply: Apply here for the pre-accelerator program (open for applications) and here for the accelerator program (not accepting applications currently)

- What they give: Pre-Accelerator teams will receive £10,000 equity free funding. Plus, all teams are eligible for £250K of credits from some of their partners, including Amazon Web Services, Google Cloud Platform, GitHub and many more

- Industry focus: No specific industry focus

- Startups funded: 150

- Exits: 77

- Exit value: No data available

- Total funding raised: $150,000,000

- Companies: 150 including Happity, DeptCase and Yooz

- Twitter Profile

Bethnal Green Ventures

Why you should apply to Bethnal Green Ventures:

If your startup is centered around a good cause, you should definitely check out Bethnal Green Ventures. The UK-based accelerator sees a growing demand for investments that mainly focus on having a positive impact on the world and is here to work with your early-stage startup.

They specifically focus on teams who try to tackle social and environmental problems that affect today’s world, in fields such as education, healthcare, democracy, and sustainability.

Their intensive accelerator program that takes place twice a year where, in addition to funding, they offer office space, mentorship opportunities, and connections, educational opportunities and life-long support.

KEY INFORMATION

- When it was founded: 2010

- Location: London, UK

- How to apply: Applications for Autumn 2022 program are now closed but you could register interest for next time here

- What they give: £30,000 investment for 7% equity and 3 months of intensive learning

- Industry focus: Technology, with a social and environmental aspect

- Startups funded: 130

- Exits: 47

- Exit value: £150,000

- Total funding raised: $42,528,272

- Companies: Some of the companies funded include ChatterBox, DrDoctor and Melia

- Startup Directory, Twitter Profile

Andy, Agry Monk Co-FounderThe sales sprint was transformational for me. I realised that persistence, structrure and organisation aqre cdentral to it all, and it’s all about operating an effetive process.

Iceland

Startup Reykjavik

Why you should apply to Startup Reykjavik:

How does the idea of spending a summer in Iceland to help scale your startup sound? Startup Reykjavík, a mentorship-driven seed stage investment program, runs a 10-week intensive program every year from June to August in the Icelandic capital.

As part of their program, they offer funding and free office space, as well as mentorship from their network of over 90 mentors and connections to investors.

Startup Reykjavík is flexible in which companies they choose to work with, accepting both early and late-stage startups. Note that you can apply from anywhere in the world, as long as you are willing and able to relocate for the 3-month program.

KEY INFORMATION

- When it was founded: 2012

- Location: Reykjavik, Iceland

- How to apply: Applications for 2019 are closed, but keep an eye on this page

- What they give: $23,000 in exchange for 6% equity

- Industry focus: No specific industry focus

- Startups funded: 82

- Exits: 44

- Exit value: No data available

- Total funding raised: $5,046,376

- Companies: Some of the companies funded include Proency, Nordverse and Mure VR

- Startup Directory, Twitter Profile

Mathieu Grettir Skúlason CEO and Co-Founder of Flow EducationNo degree, studies or work in the industry can prepare you for the real world the way the Startup Reykjavík Accelerator does for entrepreneurs and startups. You will be amazed with what can be achieved in only 10 weeks

Greece

Metavallon

Why you should apply to Metavallon:

A venture capital firm based in Athens, Greece, Metavallon is interested in early stage technology startups with a mission to combine tech, talent and resolve. Initially launched in 2011, since 2017 they have evolved to Metavallon VC.

Apart from funding, Metavallon offers hands-on support in areas such as guidance and mentoring, alliances and partnerships, training, talent acquisition, coaching, and networking. They are also able to provide office space in Athens, Greece, on a case by case basis.

KEY INFORMATION

- When it was founded: 2011

- Location: Athens, Greece

- How to apply: Apply here

- What they give: 200,000€ – 400,000€ for pre-seed investment and 400,000€ – 1,000,000€ for seed investment in exchange for equity

- Industry focus: Technology

- Startups funded: 28

- Exits: 3

- Exit value: No data available

- Total funding raised: No data available, but Metavallon VC has a 32,000,000€ fund for investment in startups

- Companies: Some of the companies funded include Citizen, Useberry and Racecheck

- Startup Directory, Twitter Profile

Egg

Why you should apply to the Egg:

One of Greece’s most notable startup incubators, Egg (the name stands for Enter-Grow-Go) offers to help your startup grow within the course of a year through a mixed incubator, accelerator, and coworking program. Their focus is both on early-stage startups and companies that want to scale up.

Note that you will have to be located, or willing to relocate to Athens and that there is a monthly fee of 45 euros, to keep the coworking space running, but the whole amount you paid at the end of your tenure will be given to a charity foundation of your choice.

Egg gives you access to different funding modes such as a 75,000 euros bank loan, equity funding and EU programs such as Horizon.

KEY INFORMATION

- When it was founded: 2013

- Location: Athens, Greece

- How to apply: Applications start on February 2022, you can send your application online until May of 2022. They provide step-by-step instructions here

- What they give: Mentoring, coworking space and access to different funding modes

- Industry focus: No specific industry focus

- Startups funded: 168

- Exits: No data available

- Exit value: No data available

- Total funding raised: 34,600,000€

- Companies: More than 150, including RETHING, Infin8 and BAAM

- Startup Directory, Linkedin Profile

Germany

ProSiebenSat.1 Accelerator

Why you should apply to ProSiebenSat.1 Accelerator:

Based in Berlin and Munich, ProSiebenSat.1 Accelerator invests in B2C startups offering mass-market relevant products or services.

They offer funding for advertising volume, helping your startup reach a mass market audience. Apart from that they also provide mentoring, office space in Berlin, as well as access to the network of one of the largest media corporations in Europe.

Note that, to be considered, you need to already have gained some traction and revenue (anywhere between 500,000€ and 2,500,000€).

In the first nine months of 2022, ProSiebenSat.1 generated revenues of almost 3,000,000,000€.

KEY INFORMATION

- When it was founded: 2013

- Location: Berlin and Munich, Germany

- How to apply: Contact them here

- What they give: 1,500,000€ in advertising volume (in the form of multimedia campaigns) for equity TBD

- Industry focus: All industries with a B2C focus

- Startups funded: 80+

- Exits: 5

- Exit value: No data available

- Total funding raised: $9,227,696

- Companies: More than 80, including Parshipmeet Group, SevenPictures, and Snowman Productions

- Startup Directory, Twitter Profile

Axel Springer Plug and Play Accelerator

Why you should apply to Axel Springer Plug and Play Accelerator:

Their unconventional name notwithstanding, Axel Springer Plug and Play Accelerator is a joint venture between Axel Springer SE, a leading company in the German print business and Plug and Play Tech Center, an international startup accelerator in California — so your digital startup can benefit from some truly global opportunities, including mentorship and support in a wide range of topics.

Axel Springer Plug and Play Accelerator have also started a residence for artists, with the belief that interesting things happen when different people come together.

Recently, they teamed up with Porsche to form APX, a new accelerator for digital business models.

Axel Springer Plug and Play Accelerator stopped its active acceleration activities at the end of 2017 but remains active shareholders for their portfolio companies.

KEY INFORMATION

- When it was founded: 2013

- Location: Berlin, Germany

- How to apply: Axel Springer has teamed up with Porsche to form a new accelerator called APX for digital business models in Berlin. Companies can apply here

- What they give: $30,000 for 5% equity

- Industry focus: No specific industry focus

- Startups funded: More than 100 portfolio companies

- Exits: 12

- Exit value: $4,800,000

- Total funding raised: $44,713,279

- Companies: More than 100, including TalentSpace, RoomAR and careship

- Startup Directory, Twitter Profile

EWOR

Why you should apply to EWOR:

EWOR focuses on talent investing and takes a unique approach to accelerator programs by committing to entrepreneurs even at the pre-idea stage.

They offer two fellowship programs: the Pre-idea Fellowship and the Post-idea Fellowship. The Pre-idea Fellowship is a 10-month program aimed at helping entrepreneurs launch a venture from scratch, while the Post-idea Fellowship is a 6-month program designed to fast-track the learning process for entrepreneurs who already have a startup idea.

Both programs focus on providing world-class lectures, coaching from experienced entrepreneurs, and investment opportunities from EWOR up to €150k in early-stage startups at a €1.0M and €1.5M valuation cap. Participants can also pitch to high-profile investors at EWOR events.

What is very exciting about EWOR, is that its founders are entrepreneurs themselves so they have a great understanding of your challenges and worries. They have successfully built and sold companies, such as ProGlove, which was sold for €500M. The advisors include 7 unicorn founders, further adding to the wealth of experience available to the startups they support.

KEY INFORMATION

- When it was founded: 2020

- Location: Bamberg, Germany – Programs are 100% online

- How to apply: You can apply for their Pre-idea Fellowship or Post-idea Fellowship here.

- What they give: €75k-150k funding at a €1.5m post-money cap for Pre-idea Fellowship startups and €1.0m post-money cap for the Post-idea Fellowship startups, introductions to a variety of angels and VCs all over the globe, in exchange for 3% equity for the Pre-idea Fellowship (the post-idea fellowship, is for free, they don’t take any additional incubation fee)

- Industry focus: No specific industry focus

- Startups funded: More than 50

- Exits: Data not available

- Exit value: Data not available

- Total funding raised: Data not available

- Companies: More than 50, including Flike, Patchwork Hub, NUWE, SOKR

- Success Stories

Estonia

Startup Wise Guys

Why you should apply to the Startup Wise Guys:

Startup Wise Guys are Europe’s leading B2B startup accelerator and one of the top investors in the CEE region and the Nordics. Their 3-month intensive programs offer high energy and straightforward coaching and mentoring to help you cross the finish line.

Their main areas of focus are B2B SaaS, Fintech and CyberNorth.

The accelerator program focuses on sales and scaling up, helping you shape your product to reach customers, with the help of their network of over 150 international and local mentors. They also offer Demo Days and the opportunity for you to participate in startup fairs and tech summits.

Startup Wise Guys have had 2 major exits up to date – Estonian AgTech company VitalFields was acquired by Climate Corporation in 2016, whereas AI giant UiPath has just acquired Ukraine based StepShot.

KEY INFORMATION

- When it was founded: 2012

- Location: Tallinn, Estonia. They also have accelerator locations in Riga, Latvia, and Vilnius, Lithuania

- How to apply: Fill in an application here. Currently, applications are open to B2B SaaS and Fintech programs

- What they give: Up to 30,000€ equity investment with follow-on possibility

- Industry focus: B2B SaaS, Fintech, CyberSecurity

- Startups funded: More than 300+ early-stage startups with founders from more than 40 countries

- Exits: 11

- Exit value: No data available

- Total funding raised: 12,600,000€ (amount raised by portfolio startups 29,000,000€)

- Companies: More than 300, including EstateGuru, CallPage and Fractory

- Startup Directory, Twitter Profile

Vladislav Kochetov, founder of RealtifyThe Startup Wise Guys acceleration program is the best in terms of the educational value that you get. The mentors, the connections, the ideas, the education, the entire process, and the Startup Wise Guys team, all provide the energy and skills to motivate and equip new founders to take their startups to the next level.

Latvia

Buildit Accelerator

Why you should apply to Buildit Accelerator:

Established in 2014 in Estonia and having expanded to Latvia, Buildit Accelerator aims to take your startup idea in hardware or Internet of Things and turn it into a market-worthy product. They select companies to invest in twice a year.

At Buildit Accelerator they focus on B2B solutions such as Connected Industry and Software for productivity, as well as Smart Living (B2C) solutions on areas such as Energy, Mobility, and HealthTech.

What sets them apart is that they offer what they call a “full-stack accelerator” program. This means that you get a Pre-Seed fund and 3-month Accelerator Program, as well as additional Seed funding with a follow-on support program for more than 2 years.

KEY INFORMATION

- When it was founded: 2014

- Location: Riga, Latvia

- How to apply: By filling in an application here

- What they give: Up to €50,000 as a convertible loan with discount and valuation cap

- Industry focus: IoT, hardware

- Startups funded: 50

- Exits: 32

- Exit value: No data available

- Total funding raised: $1,537,492

- Companies: Some of the companies funded include Naco Technologies, BeeSage and Alternative Plants

- Startup Directory, Twitter profile

Indrek Jaal, Founder & CEOBuildit helped GlobalReader grow from just-few-guys-who-started-something-cool to a working company. We were given a mindset to always think big and we are still doing it. Thanks Buildit!

Czech Republic

StartupYard

Why you should apply to StartupYard:

StartupYard is Central Europe’s leading accelerator for technology startups — mostly geared toward ‘Deep Tech’ startups that are solving challenging technology problems.

Their three-month program (you will need to relocate to Prague) is addressing early to seed-stage companies and offers mentorship and corporate partnerships with companies from various industries. You also get access to their extensive network including mentors from companies such as Vodafone, Accenture, and Google.

Some of their most notable exits include digital customer service platform BrandEmbassy and cyber-security company TeskaLabs.

KEY INFORMATION

- When it was founded: 2011

- Location: Prague, Czech Republic

- How to apply: Applications are currently closed, but you can register your interest here

- What they give: 20,000€ in initial seed funding via a convertible note

- Industry focus: Technology

- Startups funded: 91

- Exits: 11

- Exit value: $340,000

- Total funding raised: 100,000,00€

- Companies: Some of the companies funded include AirCharts, Leo Rover and evolso

- Startup Directory, Twitter profile

Pavel Konecny Founder, Neuron SoundwareIt’s not about dreams, it’s about vision. StartupYard helped us to find a path– a way to make our vision a reality.

China

Orbit Startups

Why you should apply to Orbit Startups:

A leading startup accelerator in China, Orbit Startups is a mentorship-driven program that can bring your internet startup to the next level — and no, you don’t have to be based in China to apply. In fact, they have funded startups from 40 different countries.

Like HAX, Orbit Startups is also part of the venture fund SOSV, a global venture capital firm with over $1.5 billion in assets under management and currently deploying a $277 million flagship fund SOSV IV.

Prepare for 3 months to 6 weeks of rigorous guidance, training and resources from mentors, partners, and investors. They also offer support post-accelerator, through their robust and supportive alumni network.

One of the most notable exits, Launchpilots, an online platform connecting brands with university students, was acquired by Robin8 Inc.

KEY INFORMATION

- When it was founded: 2010

- Location: Shanghai, China

- How to apply: You can apply here

- What they give: Over $2,000,000 in perks and discounts from AWS, Google, HubSpot and many more in exchange for 6% equity

- Startups funded: 310

- Exits: 15

- Exit value: No data available, but 80.6% of their companies receive funding after Demo Day

- Total funding raised: Over $286,000,000 in follow-on funding

- Companies: More than 300, including Phable, Videoverse and Achiko

- Startup Directory, Twitter profile

HAX

Why you should apply to HAX:

Part of global venture capital firm SOSV, HAX is an immersive accelerator program committed to getting you from the idea stage to look-a-like prototype in less than 3 months.

Focusing on startups with a hardware element, they accept 4-5 selected startups per month. If you are accepted with HAX you will first join their China location where you will spend 4-8 months focusing on R&D and prototyping, and then move to their location in SF to spend three months focusing on growth, fundraising, and business development.

Some of their most notable exits include Riot Games, an online game development company that got acquired by Tencent Holdings.

KEY INFORMATION

- When it was founded: 2011

- Location: Shenzhen, Guangdong, China

- How to apply: You can fill out the form here

- What they give: An investment package of $250,000

- Industry focus: Hardware

- Startups funded: 554

- Exits: 6

- Exit value: No data available for Riot Games or overall, but one of their other companies (Kindara, a fertility platform) exited for 8.4 million USD

- Total funding raised: $1,760,000,000

- Companies: More than 500, including Somatic, Formlabs and Particle

- Startup Directory, Twitter profile

AnonymousWorking with the HAX team was the turning point in our business and technology to scale.

Canada

Highline Beta

Why you should apply to Highline:

Starting as Highline in 2014 and eventually evolving to Highline Beta in 2017, this startup co-creation company turned venture creation firm can help your startup reach market-leading levels through their network of investors and the backing of foundations such as Extreme Startups and GrowLab.

Part of their invested startups with notable exits include science search engine Meta which was acquired by the Chan Zuckerberg Initiative and FameBit which was acquired by Google.

If you are based in Toronto or don’t mind relocating, you can take advantage of both their co-creation program where you (as a founder) will be partnered with enterprises to form a new startup, as well as their two types of accelerators; Commercial Deal and New Venture.

KEY INFORMATION

- When it was founded: 2014

- Location: Toronto, Ontario, Canada. They also have locations in Vancouver and New York City

- How to apply: You can join their co-creation program by applying here, or choose one of their accelerator programs on their website

- What they give: $50,000 investment with a 10% equity

- Industry focus: Technology, but they have a broad spectrum

- Startups funded: 64

- Exits: 10

- Exit value: No data available, but the collective worth of all invested companies is over $765,000,000

- Total funding raised: $40,876,738

- Companies: Some of the companies funded include AVIVA, AB InBev and Intuit

- Startup Directory, Twitter profile

Shruti George, Vice President, Strategic Innovation Platforms, Avery DennisonHighline Beta has been a true thought partner for our global accelerator program, helping us move at warp speed – from idea to Cohort 1 launch in 3 months. They are able to straddle strategic and the tactical; going from program design, problem definition and brand building all the way to guiding the recruiting and application process. They are helping us build a whole new muscle and inspiring our organisation to find external solutions to our biggest business problems

FounderFuel

Why you should apply to Founderfuel:

A mentor-driven, three-month accelerator program, FounderFuel is backed by seed-stage tech venture capital firm Real Ventures and boasts a broad startup network in Canada and beyond.

To join the immersive accelerator program you will have to be based in Montreal for all three months (they provide an office space) but this will also give you the opportunity to present your work at Canada’s largest Demo Day.

Note that FounderFuel does not support individual applications: you need to have a founding team of at least two people to be able to apply.

KEY INFORMATION

- When it was founded: 2011

- Location: Montréal, Quebec, Canada

- How to apply: Contact them on their website

- What they give: $120,000 CAD investment split into two parts, with the $20,000 CAD invested up front for a 5% equity and the remaining $100,000 CAD invested in a SAFE with a $3.5M cap and 20% discount

- Industry focus: Technology

- Startups funded: 114

- Exits: 56

- Exit value: No data available, but one of their most notable companies, Crew, a curated platform connecting designers and developers with clients, exited for 9.9 million CAD

- Total funding raised: $470,000,000

- Companies: More than 100, including Binder, Gravy and LunchBox

- Startup Directory, Twitter profile

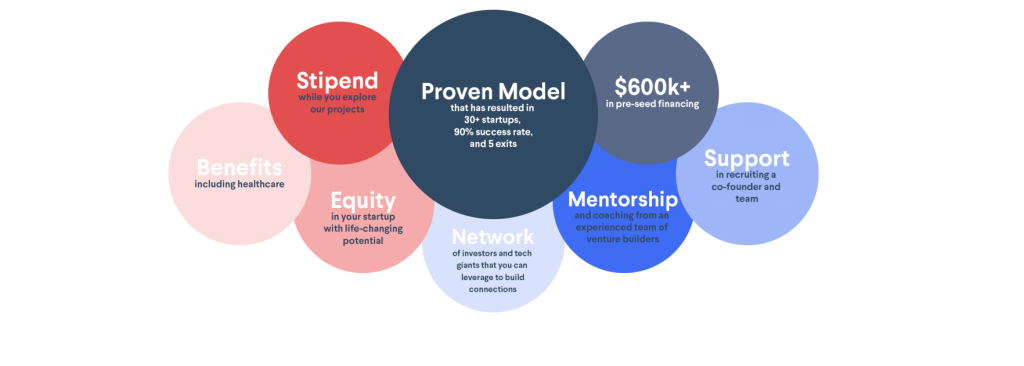

Tandemlaunch

Why you should apply to Tandemlaunch:

Since 2010, TandemLaunch has been working with brilliant entrepreneurs to build companies around university technologies. Their network of industry and university partners is global, extensive and very valuable to their process.

TandemLaunch takes a unique approach to building start-ups. They start by identifying industry problems, then scout technologies to solve them and assemble a team to help build a company together.

Unlike other incubators, they take pride in not only offering a large amount of funding but they also take the time to provide mentorship, coaching and the opportunity for co-creation.

KEY INFORMATION

- When it was founded: 2010

- Location: Montreal, Canada

- How to apply: Fill in your application here

- What they give: $600,000 pre-seed financing

- Industry focus: Tech

- Startups funded: Over 30

- Exits: 10

- Exit value: No data available

- Total funding raised: Over $250,000,000 in capital raised

- Companies: More than 30, including Corowave, Algolux and AAVAA

- Startup Directory, Twitter profile

Sahil Gupta, MEng, Co-Founder at SoundskritI thought it was a good place to found something very innovative. I also liked the fact that the incentives are a lot more aligned, at TandemLaunch they really try to push you to the finish line.

Bulgaria

LAUNCHub

Why you should apply to LAUNCHub:

LAUNCHub Ventures may be based in Sofia, Bulgaria, but they are not hesitant to invest in companies worldwide. With a strong tech background and focus, LAUNCHub Ventures are looking to help people with innovative ideas scale up.

Their first fund, when the company launched in 2012, backed 62 startups that have now attracted over 20 million euros in follow-up funding, led by LAUNCHub Ventures.

Apart from the considerable funding amount they provide (that can reach up to 2,5 million for “the right startup”), LAUNCHub Ventures position themselves as a partner, providing you with expertise and resources. Speaking of which, their portfolio companies include goal management platforms Gtmhub and Charlie Finance among others.

KEY INFORMATION

- When it was founded: 2012

- Location: Sofia, Bulgaria

- How to apply: You can apply any time by contacting them directly on their website

- What they give: Between 300,000-700,000 euros usually, equity depending on the investment

- Industry focus: Mostly SaaS, Enterprise Software, Health-tech, E-commerce, Mobile, IoT, but they claim to be “sector agnostic” so don’t hesitate to apply if you’re in a different niche

- Startups funded: 129

- Exits: 45

- Exit value: One of their invested companies, Codebender, exited for USD 1.1 million

- Total funding raised: $27,000,000

- Companies: More than 100, including Connecto, Aggero and Taylor & Hart

- Startup Directory, Twitter profile

Ivan Osmak CEO, GTMHubTaking an investment from LAUNCHub Ventures was one of the best decisions we made in our early days. The team has proven to be our trusted partner by extending their support well beyond the funding-strategic advice on critical decisions, building operational structures and introductions to next stage investors. A true value add investor we are proud to have

Eleven Startup Accelerator

Why you should apply to Eleven Startup Accelerator:

If your tech idea has proof of concept and early traction, and you are willing to relocate to Sofia, Bulgaria, to live under one roof with other promising entrepreneurs, then the Eleven Startup Accelerator may be a great option for you.

Although most of their investments are in Southeast Europe, they are focusing on early-stage investments from anywhere, and they have a global network of investors.

The 100,000 euros of the original investment (with the option to double that amount and raise up to 5 million from their network of investors) will certainly help you scale up.

KEY INFORMATION

- When it was founded: 2012

- Location: Sofia, Bulgaria

- How to apply: They have a rolling application, so at any time you can fill out and send your project for review here

- What they give: 250,000€ - 1,000,000€ for a 10-12% equity to promising tech companies

- Industry focus: Tech and innovation

- Startups funded: 150+

- Exits: 5

- Exit value: No data available, but the total value of their portfolio companies is currently at $85,500,000

- Total funding raised: $10,985,023.66

- Companies: More than 150, including Native Teams, Rush and Payhawk

- Startup Directory, Twitter Profile

Mihail Stoychev, CEO & Co-founder of SMSBumpDynamic thinking, networking abilities and willingness to get involved are among the top 3 traits that make a great VC. I believe Eleven has all of them. They were like a superstar coach which you can use whenever necessary: making sure you are always on track and improving without being overwhelming.

Australia

Incubate

Why you should apply to Incubate:

If you are a student, an alumni or researcher with the University of Sydney, Australia, you should definitely check out the award-winning, 14-week accelerator program at Incubate. Incubate itself was created by two students, so you know they take young entrepreneurship seriously.

They have funded more than 100 startups, among the most notable being Persollo, the world’s first instant checkout platform for small merchants and brands across social networks that has been featured in Forbes 30 under 30.

Note that you will have to be located in Sydney, in order to take advantage of the exclusive workshops on campus and the 1:1 mentorship.

KEY INFORMATION

- When it was founded: 2012

- Location: Sydney, Australia

- How to apply: Applications for the next INCUBATE Accelerator are closed. Register your interest to be notified when they open here

- What they give: $5,000 equity-free seed funding, but they also provide 1:1 mentorship, exclusive masterclasses, and free office space

- Industry focus: Technology, mainly

- Startups funded: 125+

- Exits: 78

- Exit value: No data available

- Total funding raised: $30,000,000

- Companies: More than 125, including ReelMe, Opacity and AusAir

- Startup Directory, Twitter profile

Michelle Deaker, FOUNDING PARTNER, ONEVENTURESThere is an enormous amount of satisfaction in contributing to a legacy of developing the next generation of leading entrepreneurs and businesses.

Innovyz

Why you should apply to Innovyz:

Innovyz may have been founded in 2009 but the minds behind it have been shaping the landscape of business accelerating in Australia and internationally since the nineties. You don’t have to relocate to Adelaide however, as their program is not full-time — which is great if you are not ready to leave your day job quite yet.

Focusing mainly on energy and related industry fields (such as advanced materials and manufacturing), Innovyz also help with commercialisation projects through their Innovyz Special Projects Department. They do this over a 12 month commercialisations, process where their team provides end-to-end support to bring innovations, research and ideas to market. You can also apply as an individual.

One of their alumni companies is Titomic, specializing in innovative applications in industrial scale additive manufacturing for metals.

KEY INFORMATION

- When it was founded: 2009

- Location: Adelaide, Australia

- How to apply: You can contact them here

- What they give: $10,000 toward costs, but also offer more than $150, 000 worth of staff assistance over the course of the 12 months

- Industry focus: Energy, agriculture, food sector, mining & resources and advanced manufacturing, among others

- Startups funded: 80+

- Exits: 1

- Exit value: No data available

- Total funding raised: Their total estimated current value across all their companies is $501,960,000

- Companies: More than 80, including Bluedot, XFrame and Metrix Care

- Startup Directory, Twitter profile

Melbourne Accelerator Program

Why you should apply to Melbourne Accelerator Program: