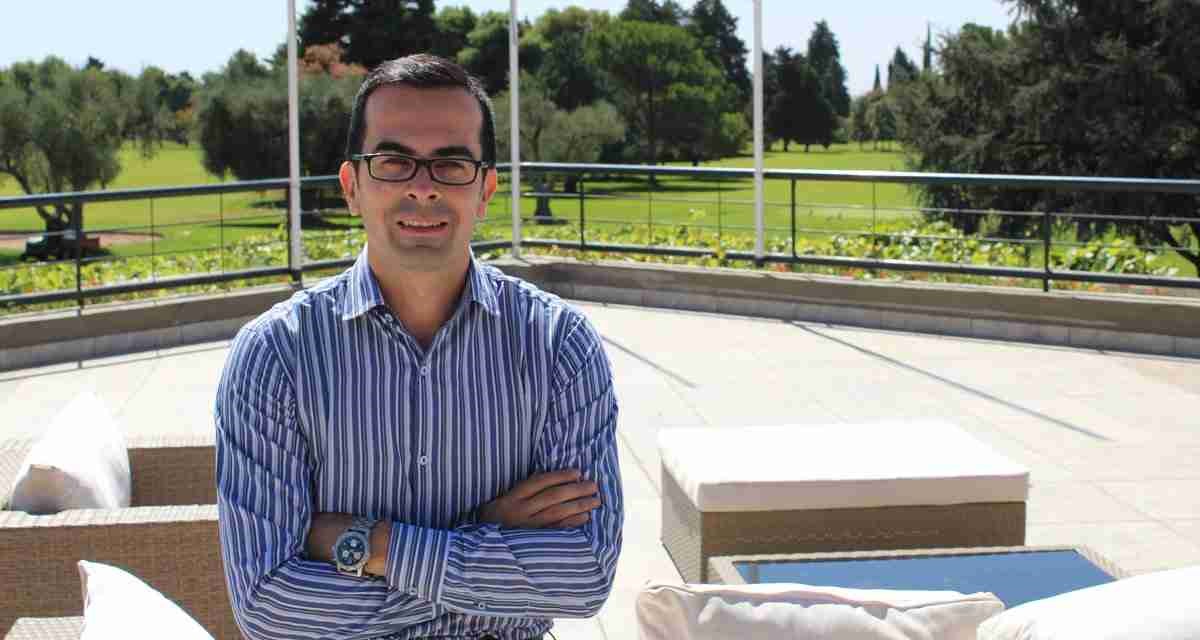

Meet Sergio E. Cusmai from AiphaG

Q: Can you introduce yourself?

A: I’m Sergio E. Cusmai from Argentina, and my entrepreneurial journey began after a stint in London working for lastminute.com. Despite a successful career, the idea of entrepreneurship always appealed to me. In 2006, I returned to Argentina and launched my own company, although my initial idea didn’t take off as expected. However, a chance LinkedIn contact led me to work with a company in the Netherlands, which eventually brought me back to Argentina. There, I grew the company to 150 full-time employees.

My exposure to venture capital (VC) and investment groups like Mangrove and Naspers MIH was a turning point. The adrenaline rush from a high-stakes meeting where a significant investment was made spurred my interest in VC. This led to the creation of five companies between the Netherlands and Argentina, and our current venture, Aipha G, is based in the US and Argentina. We are also exploring expanding into European countries like Luxembourg, Poland, and Spain.

Why Founder Institute?

Q: What led you to join the Founder Institute eventually?

A: My journey into the world of startups was not straightforward. Coming from a country known for industries other than tech, I had to overcome skepticism and learn the ropes of pitching and navigating the startup ecosystem. The Founder Institute caught my attention as a prominent US-based accelerator program reaching our region. It offered a structured path to turn a business idea into something tangible and investable. I joined not just as a student but also became a director and mentor, being the only individual to experience all levels of the Founder Institute.

The program was instrumental in teaching me how to structure a company, manage a data room, and understand the nuances of startup development. Although initially, the equity requirement seemed high, the push and support provided by the Institute were invaluable in focusing on critical aspects of business development that often get sidelined in the day-to-day operations of a startup.

How a Founder Gets In

Q: Could you walk us through the application process you experienced with the Founder Institute?

A: The application process for the Founder Institute began with filling out a form. This initial step was followed by what seemed like a personality test, aimed at determining whether I possessed an entrepreneurial DNA. While I’m unsure about the test’s accuracy or standardization, it was an interesting part of the process. After completing the form and the psychological test, I had a phone call with someone from California. During this call, I was asked detailed questions about my project, particularly concerning its potential scale and future projections. A key aspect the Founder Institute seemed to focus on was the project’s scalability beyond regional boundaries. They were interested in projects that could be replicated or have relevance in multiple countries.

These three steps – the application form, psychological test, and phone interview – were the main components of the application process. Each stage seemed designed to assess not just the viability of the business idea but also the founder’s mindset and vision for the project’s growth. This thorough vetting process was indicative of the Founder Institute’s commitment to nurturing startups with global potential.

Understanding Equity and Fees in the Founder Institute Program

Q: How does the Founder Institute handle equity and fees for participating in their program?

A: In the Founder Institute, there’s a combination of a standard fee and an equity arrangement. Specifically, the program requires founders to agree to a future equity commitment, not an immediate share transfer. This arrangement comes into effect under certain conditions, such as when a company raises more than $500,000 USD. The exact nature of this equity arrangement is detailed in a specific document, which I can’t recall the name of at the moment. Essentially, it allows the Founder Institute to exercise their rights and become a part of the company in the future, particularly during a significant funding round. This setup means that while you don’t immediately give up a share of your company upon joining the program, there is an agreement in place for the Founder Institute to claim a percentage of equity (about 6% in our case) in the event of substantial fundraising. This approach aligns the interests of the Founder Institute with the long-term success of the startups in their program, as their equity stake becomes meaningful only when the company achieves a certain level of financial success.

Daily Routine and Challenges in the Founder Institute Program

Q: What was your daily routine like in the Founder Institute program, and how did you navigate the challenges?

A: The Founder Institute program required a significant commitment, with mandatory attendance for weekly sessions. Between these sessions, there was a considerable amount of homework with strict deadlines. This work had to be completed and submitted online before each class. A key component of the program was pitching. Every week, we had to present our pitch to a different set of jury members or mentors who would evaluate and score it, followed by feedback. This constant pitching was an excellent training ground for honing presentation skills. However, it also presented a challenge: receiving mixed feedback from mentors. One mentor might praise certain aspects of the pitch, while another could express dissatisfaction for not including specific information. This discrepancy in feedback, within the limited time frame of two to three minutes for each pitch, was somewhat confusing and frustrating. I eventually realized that this experience was analogous to pitching to investors in real-world scenarios. Just like mentors, investors have their unique preferences and focuses, and you often only get one chance to make your pitch. The varying feedback served as training for dealing with potential frustrations and learning to adapt to different investors’ expectations. It was a practical preparation for the reality of fundraising and engaging with various stakeholders in the business world.

Significant Milestone in the Founder Institute Program

Q: What was a particularly memorable or standout moment in the Founder Institute program for you?

A: A standout moment in the Founder Institute program was the requirement to legally register our company. This step marked the transition of an idea into a tangible business entity. It’s a crucial milestone and a deal breaker in the program. If you don’t register your company, you can’t continue with the training. This requirement instills a deep sense of commitment and signifies that you’re fully invested in your venture. I found this aspect of the Founder Institute particularly impactful compared to other programs. In accelerators like Techstars or Y Combinator, there’s an expectation that you already have a legal entity or certain customer base. But in the Founder Institute, you start with just an idea that you’re looking to turn into a company. This places the program at a very early stage of entrepreneurship, making it especially suitable for those who are new to the startup world. The act of legally establishing the company serves as a point of no return, marking a significant commitment to pursuing your business idea. This requirement, unique to the Founder Institute, distinguishes it from other accelerators and underscores its focus on helping nascent entrepreneurs take their first serious step into the business world.

Areas for Improvement in the Founder Institute Program

Q: In your view, what aspects of the Founder Institute program could be improved?

A: While the Founder Institute program was largely beneficial, there are areas where improvements could enhance the experience. One aspect relates to the program’s second level, which focuses on fundraising. A negative experience I encountered was the program’s approach to leveraging the participants’ contacts. The expectation for us to provide our investor contacts felt counterintuitive, as I anticipated the program would expand our network with new potential investors. Instead, it seemed like we were contributing to their database without gaining similar access in return. This approach led me to opt out of the second level of training. Regarding the first level of the program, the feedback alignment from mentors could be better managed. As I mentioned earlier, receiving contradictory feedback from different mentors was confusing. While this can be seen as preparation for the varied responses one might receive from investors, it wasn’t explicitly communicated as such. If the program made it clear that this experience was a simulation of real-world investor interactions, it would have been more beneficial. This aspect of the program could be explicitly framed as a lesson in dealing with rejection and varying opinions from investors. Many entrepreneurs, particularly in the early stages, will face numerous rejections and differing feedback from potential investors. If the Founder Institute positioned their mentor feedback as a practical preparation for these challenges, it would add more value to the experience and better prepare participants for future fundraising endeavors.

Assessing the Impact of Founder Institute on AiphaG’s Growth

Q: How do you evaluate the influence of the Founder Institute on your current success and the growth trajectory of AiphaG?

A: It’s challenging to precisely quantify the impact of the Founder Institute on AiphaG’s growth and my personal development as an entrepreneur. Success is a multifaceted concept, and our achievements at AiphaG stem from a combination of various experiences, including what I learned at the Founder Institute. One of the key takeaways from the Founder Institute was learning to be prepared for conversations with investors. While much of this information can be found online or through other resources like Y Combinator School, the Founder Institute provided a structured environment that pushed us to focus on important aspects that might be overlooked while running a startup. The program compelled us to pay attention to crucial details that are often sidelined in the hectic pace of startup development. I can certainly say that certain practices and insights gained from the Founder Institute have been integrated into my day-to-day operations at AiphaG.

However, attributing a specific measure of our success to the Founder Institute alone is complex. In addition to the Founder Institute, other experiences have also contributed significantly to our growth. For instance, participating in Mentor Day in Spain, where we were recognized as the most investable startup, was a milestone achievement. Some of the groundwork laid during our time at the Founder Institute undoubtedly played a role in this recognition. In conclusion, while the Founder Institute was an important stepping stone in our journey, it’s one of several experiences that have collectively shaped AiphaG’s growth and my evolution as an entrepreneur. The program provided valuable lessons and a foundational understanding of dealing with investors, which has been beneficial to our overall progress.

Ongoing Relationship with the Founder Institute

Q: How has your relationship with the Founder Institute evolved since completing the program, especially in terms of ongoing support for your business?

A: Post-program, the Founder Institute doesn’t actively engage in day-to-day support or follow-up on daily activities of alumni. They don’t typically facilitate introductions to investors or directly involve themselves in the ongoing operations of the businesses they helped launch. However, my relationship with the Founder Institute remains positive and continues in different capacities. Recently, I was contacted by the CEO of the Founder Institute about participating in a new program designed for limited partners (LPs). This program, which is offered free of charge to select individuals, focuses on teaching how to conduct due diligence before investing. This is particularly insightful for entrepreneurs like me, as it provides an understanding of the process investors go through during due diligence. I found this opportunity both interesting and practically valuable, and I’ve decided to participate.

Moreover, as a mentor in various Founder Institute programs, my ongoing engagement with them has been fulfilling. Being based in Córdoba, Argentina, where there are few training programs of this caliber, I continue to recommend the Founder Institute to aspiring entrepreneurs. My recommendation is based on the genuine belief that they can benefit from the program, which speaks volumes about my experience with and perception of the Founder Institute. In summary, while the direct support for AiphaG from the Founder Institute has ceased post-program, the connection and benefits continue in different forms, including new learning opportunities and my role as a mentor. This relationship reflects a mutual respect and ongoing engagement beneficial to both parties.

Advice for Aspiring Entrepreneurs Applying to Accelerators

Q: What advice would you give to entrepreneurs considering applying to the Founder Institute or other accelerators?

A: When considering applying to an accelerator program like the Founder Institute or others, it’s crucial to first understand the focus or thesis of each program. Different accelerators cater to various stages of a startup’s journey. For instance, the Founder Institute is ideal for entrepreneurs who are in the ideation phase. In contrast, Y Combinator is more suited for those looking to scale their product, and Techstars targets startups that already have a product and are aiming for growth. If you decide that the Founder Institute aligns with your needs, your idea should have a global appeal. It’s not necessarily about targeting a large market; even ideas for smaller markets can be suitable, provided they have the potential to be replicated in other regions. This global scalability is what the Founder Institute typically looks for in startup ideas.

Additionally, having competitors in your space can actually be advantageous. Being the first in a market often means facing the challenge of educating users and carving out a new market space, which can be daunting and risky for investors. They generally prefer to invest in areas where there is already some established interest and market validation. So, the key pieces of advice would be to choose an accelerator that matches your startup’s stage and needs, ensure your idea has global potential and scalability, and recognize the value of having competitors as a sign of a validated market. These considerations will help you select the most appropriate accelerator and increase your chances of success within the program.