Why “Start Small” Real Estate Advice Keeps You Small Forever

“I’m completely lost on how to start a business… I don’t know if I want to expand to other countries, like Spain, Italy, Sicily… but I don’t know how it works.”

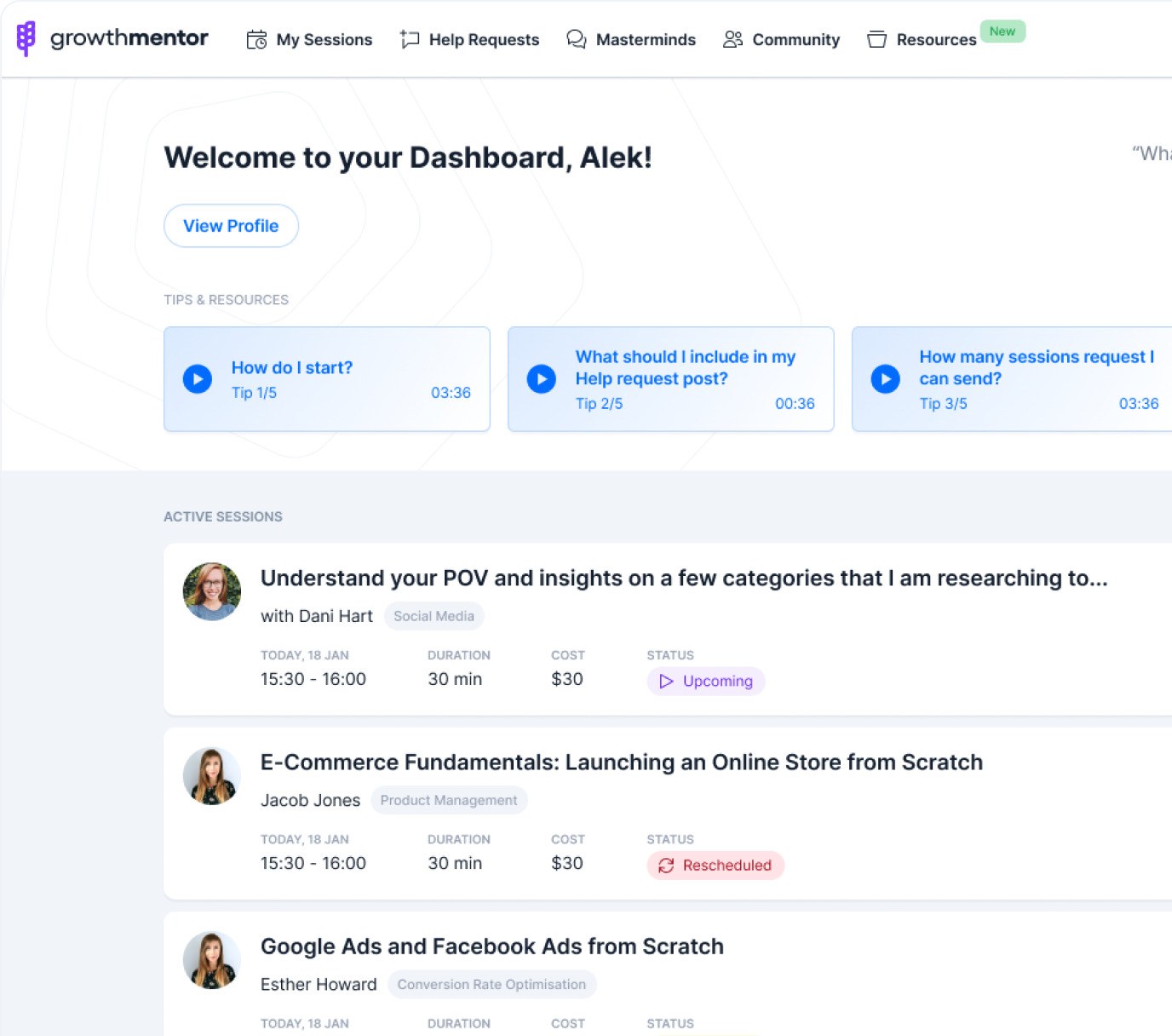

Alex had been stuck for six months when we talked on GrowthMentor. Drowning in contradictory real estate advice. Every guru, every YouTube channel, every blog post preached the same gospel: “Start small. Buy a duplex. House-hack your way to wealth.”

But Alex lives in Malta. Properties cost €300,000+.

“Starting small” meant staying small forever.

So we threw out conventional wisdom and worked backwards from his goal.

Thirty minutes later, Alex had a complete €150,000 investment plan spanning three countries.

Here’s why the backwards approach beats “start small” every time.

The Expensive Market Reality

I used to give the same advice. Start with one property. Get comfortable. Scale slowly.

Sounds sensible.

But here’s what six months of spinning his wheels taught Alex: “Start small” advice assumes you live in Ohio, where decent rental properties cost $80,000. It breaks down completely in Malta’s market reality.

“I cannot really go for a cheap one and make some renovations like most people do in other countries,” he explained. “Because here the property is so high in value, it’s kind of hard.”

Alex had followed conventional wisdom religiously. Six months of research. “Beginner-friendly” markets, cash flow calculations on imaginary starter properties.

Nowhere.

Every calculation showed him making maybe €500 per month on properties requiring €60,000 down payments. The math was brutal: at that rate, he’d need two decades to build a meaningful income.

That’s when I realized Alex needed a framework built for his reality, not generic advice designed for markets that don’t exist in his world.

The Backwards Breakthrough

“Let’s try something different,” I said. “Start with your goal and work backwards.”

Alex paused. “What do you mean?”

“You want to make money from real estate. How much? Per month.”

“I don’t know… €5,000?”

“Perfect. Now we have math.”

I grabbed my calculator. “€5,000 divided by… what could you net per property monthly in Malta?”

“Maybe €1,000 after everything?”

“So you need exactly five properties. Not one property to ‘get started.’ Five properties, or the math doesn’t work.”

Alex went quiet. Ten full seconds. I could hear him breathing.

“That’s… €150,000 in down payments.” His voice changed. “This isn’t a side hustle.”

“No. It’s serious wealth-building. But now we know what we’re solving for.”

For the first time in six months, Alex wasn’t confused.

He was focused.

Building the Framework Live

What happened next surprised both of us. Each question revealed the next logical step.

“Okay, so five properties at €30,000 down each,” I said. “Plus closing costs, reserves, improvements… we’re talking €180,000 total capital requirement.”

“Jesus,” Alex muttered. “I was trying to solve a €180,000 problem with a €10,000 mindset.”

Exactly.

“So, how long to save that?”

We calculated his current savings rate. Twenty-four to thirty-six months if aggressive.

“But wait,” Alex said. “What if Malta’s tax rates kill the returns? And how would I manage properties remotely if I buy outside Malta?”

Now we were getting somewhere. Instead of “learn about real estate investing,” Alex needed specific answers: Malta vs. Serbia tax treaties, property management costs for remote ownership, legal structures for non-resident purchasing.

“When I bought property in southern Spain,” I told him, “I thought I knew what I was doing. Then I discovered I’d pay taxes on 50% of rental income at 21%. Taxes destroy returns if you don’t plan for them.“

Alex grabbed a notebook. “So Malta’s rental income tax rates come first.”

“Absolutely. And you’ll need a team. Personal shoppers cost €2,000-€5,000 but handle everything, finding properties, managing purchases, and setting up utilities. Property managers take 3-5% monthly but give you local expertise.”

“How did you find these people?”

“Real estate meetups. Google’s personal shopper Serbia real estate.’ Build relationships before you need them.”

By the end of our call, Alex had transformed from “someday I’ll invest in real estate” to “Month 1-3: Research Malta tax structure and connect with Serbian personal shoppers.”

Why This Works Beyond Real Estate

I’ve seen this pattern dozens of times across different countries and markets. The backwards approach works because it forces you to confront reality early.

A SaaS founder told me he wanted “significant recurring revenue.” We worked backwards: €50,000 monthly = 500 customers × €100 average = specific customer acquisition costs = exact marketing budget requirements.

No more guessing about “growth strategies.”

A consultant wanted “good monthly income.” The math: €10,000 = 8 clients × €1,250 average = pipeline requirements = specific networking strategy.

No more hoping for referrals.

Most people get stuck because they start with tactics (“Should I do content marketing?“) instead of working backwards from outcomes (“I need 500 qualified leads to hit my target”).

“I finally understand what I’m actually trying to solve,” he told me. “It’s not about finding the perfect first property. It’s about building a system that can generate €5,000 per month.”

Your Backwards Blueprint

Here’s how to apply this to your own overwhelming goal, starting today:

- Grab a calculator and write down your specific monthly income target. Not your dream number, not what sounds reasonable. The number that would change your life.

- Divide that by what each unit would realistically generate monthly after expenses. That’s how many units you need.

- Multiply by the capital/time investment per unit. This is your real target, probably much bigger than you initially thought.

- List the five research questions that would change your strategy. Not general education, but decision-critical information.

- Identify two professionals in your target market and contact them this week. Don’t wait until you’re “ready to buy.”

Alex’s breakthrough wasn’t discovering some secret strategy. It was getting honest about what his goal required, then building a system to get there.

The complexity organized itself once we stopped pretending €10,000 could solve a €180,000 problem.

The Anti-“Start Small” Truth

Here’s what I’ve learned after helping founders expand into markets from Morocco to Singapore: small thinking in expensive markets means staying small forever.

When you work backwards from meaningful outcomes, every tactical decision has clear evaluation criteria. No more “Should I invest in Malta or Serbia?” now it’s “Which market delivers the yields I need for my timeline?”

The backwards approach forced Alex to confront reality early instead of pretending small steps would magically scale in an expensive market.

And that’s exactly what happened during our GrowthMentor session. Not because I had the answers, but because we built the framework together. Sometimes the most valuable thing you can do is help someone see their situation clearly enough to know which questions matter.

Your turn. Take your most overwhelming goal and work backwards. Start with where you want to end up, then build the steps to get there.

The math will be more brutal than you hoped. And more honest than any “start small” advice you’ll find.